Taxation is a vital aspect of government revenue generation, supporting public expenses and economic development. It encompasses two primary categories, i.e. direct tax and indirect tax.

Direct tax is levied directly on individuals or businesses, and indirect tax is imposed on goods and services during transactions. Understanding their distinctions helps determine the ultimate burden of taxation.

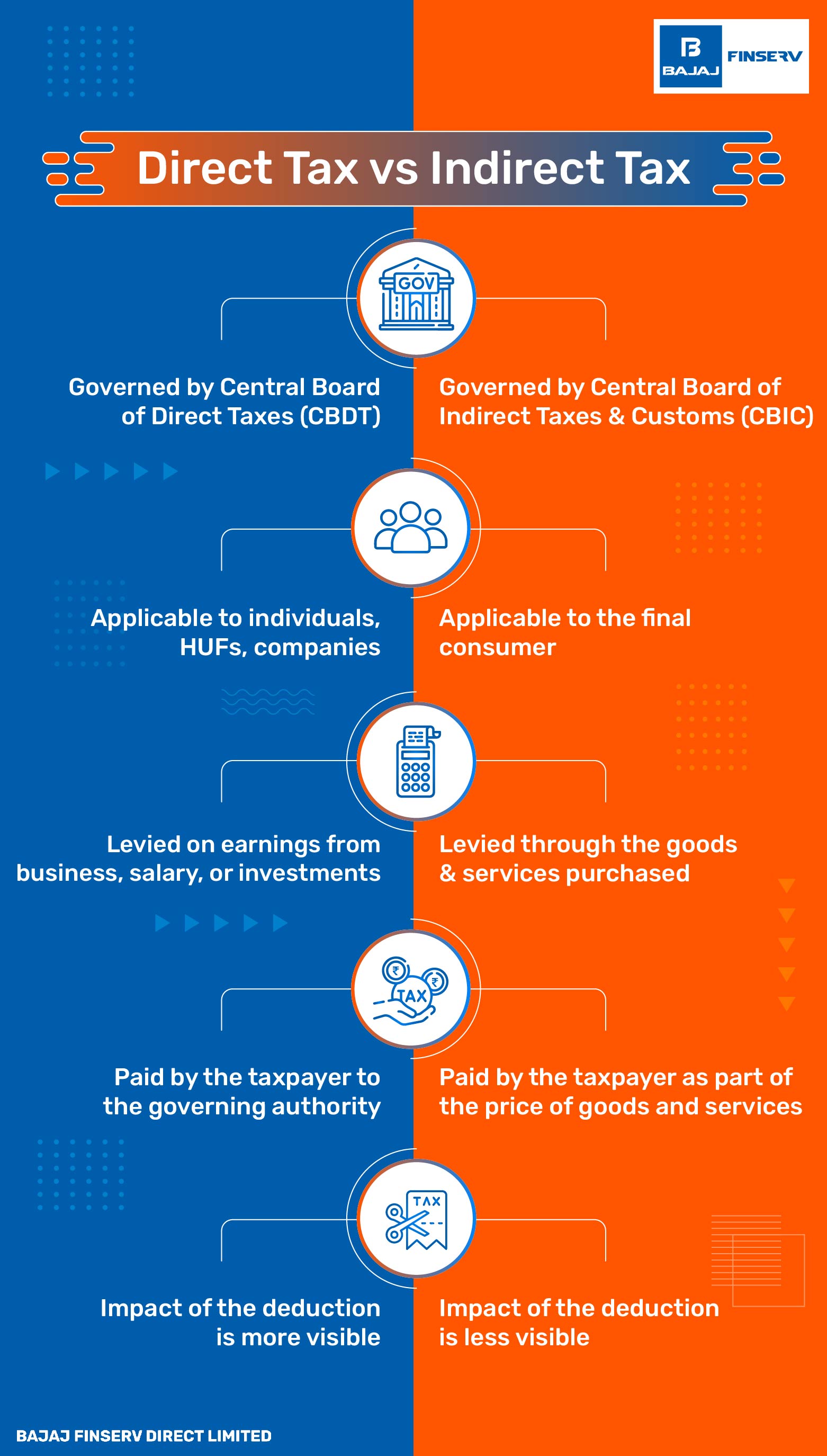

Here is a table comparing a few factors of indirect and direct tax:

Point of Difference |

Direct Tax |

Indirect Tax |

Authority in Charge |

Central Board of Direct Taxes (CBDT), governed by the Department of Revenue |

Central Board of Indirect Taxes and Customs (CBIC), governed by the Department of Revenue |

Tax Imposition |

Levied on the income or profit earned by the taxpayer |

Levied on purchases of goods and services |

Final Liability |

All individuals and businesses, except those who are exempt |

Final liability falls on the end consumers |

Course of Payment |

Taxpayers pay this tax to the authorities directly |

Taxpayers pay this tax to the authorities via an intermediary (indirectly) |

Tax Rate |

Depends on the income tax slab the taxpayer belongs to |

Same for all taxpayers |

Nature of Tax |

Progressive tax - The rate increases with the taxpayer’s income |

Regressive tax - Everyone pays the same tax, causing a disproportion of tax burden between the rich and poor |

Transferability |

The taxpayer cannot transfer the liability to another individual or entity |

The taxpayer can transfer the liability to another individual or entity |

A direct tax is paid directly to the government by individuals or businesses and cannot be transferred. This tax generally applies to the income, assets, or profits earned throughout the financial year. The tax amount depends on the income tax slab you fall under.

Here are some examples of direct tax:

Income Tax

This considers the value appreciation and earnings of all the assets and income sources of the individual. A similar system of ‘corporate tax’ is in place for businesses.

Wealth Tax

This tax applies to high-net-worth individuals. For those with a net wealth of more than ₹30 Lakhs, wealth tax is levied at 1%.

However, this was abolished in the 2015 budget. Instead, the additional surcharge was increased by 2% to 12%. This applies to individuals with an income of over ₹1 Crore, and businesses with an income of ₹10 Crores or more per year.

Indirect taxes are transferable taxes, where the final liability to pay is transferable onto others. This is levied on goods and services rather than the taxpayer's earnings.

Generally, sellers, manufacturers, and service providers collect this tax from customers and pay it to the government. The tax amount depends on several factors, including the price of the product or service.

Check out some examples of indirect taxes that will help you understand the concept better.

Service Tax

Service providers all over India must pay this tax except those covered under the negative list of services.

Entertainment Tax

This applies to commercial entertainment, such as movie tickets, music festivals, cricket matches, etc.

Indirect taxes can be transferred to others, and they're imposed on goods and services. Generally, sellers, manufacturers, and service providers collect this tax from customers and pay it to the government.

The tax amount depends on several factors, including the price of the product or service.

Check out some examples of indirect taxes that will help you better understand the concept:

Service Tax

Service providers all over India must pay this tax except those covered under the negative list of services.

Entertainment Tax

This applies to commercial entertainment, such as movie tickets, music festivals, cricket matches, etc.

Now that you know the difference between direct and indirect tax, here is a look at their benefits:

1. Pros of Direct Tax

Ensures equitable contribution from taxpayers

Curbs inflation

2. Pros of Indirect Tax

Ensures guaranteed and equal contribution from all

Easy collection

There are also downsides to consider while discussing the difference between direct and indirect taxation.

1. Cons of Direct Tax

Tax payment procedure is lengthy, complex, and cumbersome

May put a restriction on investments

2. Cons of Indirect Tax

Uniform charges may appear unfair to lower-income classes

Increases the cost of goods and services

Now that you know the difference between direct and indirect tax, remember that certain investments can help you lower your direct tax, i.e., income tax liability. Moreover, such an investment can help you save for the future or meet a specific financial goal.

On Bajaj Markets, explore popular investment tools like NPS, ELSS funds, and FDs, among others. With leading issuers and partners onboard, you can easily begin your investment journey in just a few clicks.

FAQs on the Difference Between Direct and Indirect Tax

What is direct tax?

Direct tax is a tax paid directly to the government by individuals and organizations. Examples include income tax, corporate tax, and property tax.

Is stamp duty a direct tax?

Yes, stamp duty is a direct tax imposed by the government on property transactions, paid by the individual involved in the transaction.

What are five examples of direct costs?

Five examples of direct costs are raw materials, direct labour, manufacturing supplies, fuel, and certain utilities.

Is GST a direct or indirect tax?

GST is a type of indirect tax. It is a single domestic indirect tax levied at every point of sale.

What is the need for direct tax?

Direct tax aims to collect taxes from taxpayers according to their paying capacity. That is why the tax rates are high for high-income slabs.

How to know my income tax liability?

Many financial websites, including the Income Tax Department site, offer income tax calculators. You can use these to estimate your tax liability, provided that you have the accurate data requested.

Is capital gains direct or indirect tax?

Capital gains are not a type of tax but rather a form of income. The capital gains tax is a type of direct tax, as it applies to the profits generated on the sale of an asset.

What are the various types of indirect taxes?

Different types of indirect taxes include Goods and Services Tax (GST), entertainment tax, and customs duty, among others.

What are the types of direct tax?

One popular example of direct taxation is income tax. Others include gift tax, corporate tax, capital gains tax, and more.

Is gift tax a direct tax?

Yes, gift tax comes under the category of direct tax since it is levied under the Income Tax Act, 1961.