Launched by the Government of Karnataka, the E-Swathu Karnataka is an online portal designed to provide easy access to property ownership details

To make property-related transactions transparent, the Government of Karnataka launched the E-Swathu portal in 2021. It records and maintains all property and land ownership details of rural Karnataka.

This portal is a centralised digital platform for all your land-related needs. It enables quick access to crucial property details to streamline registration processes.

E-Swathu not only simplifies bureaucratic procedures but also enables citizens to access important property documents like Form-9 and Form-11.

Check out the details of the E-Swathu portal in the table below:

Name |

E-Swathu |

Launched by |

Government of Karnataka |

Objective of the Portal |

Reduce property scams and document forgeries |

Online Portal |

https://eswathu.karnataka.gov.in/ |

Email ID |

|

Toll-free Helpline Number |

080-22032754 |

By addressing previous challenges in property record management, E-Swathu enhances transparency and efficiency. Here are the key features that highlight its significance:

Ownership Verification: E-Swathu enables the clear establishment of property ownership

Record Maintenance: It effectively maintains comprehensive records of property ownership

Property Attributes Documentation: Serving as a detailed reference for rural properties in Karnataka, E-Swathu captures essential information about their physical attributes

Information Sharing: One of the primary objectives of E-Swathu is to improve the sharing of property records among Gram Panchayats, courts, and urban planning authorities.

Comprehensive Property Details: The platform includes all relevant information concerning properties, such as ownership transfers, gifts, legal cases, inheritances, and acquisitions.

Language Accessibility: Although E-Swathu is primarily offered in Kannada, it also provides English translation options, significantly improving its accessibility for a wider audience

Digital Signatures: All forms within E-Swathu are digitally signed by the Panchayat Development Officer (PDO), eliminating the need for traditional ink signatures

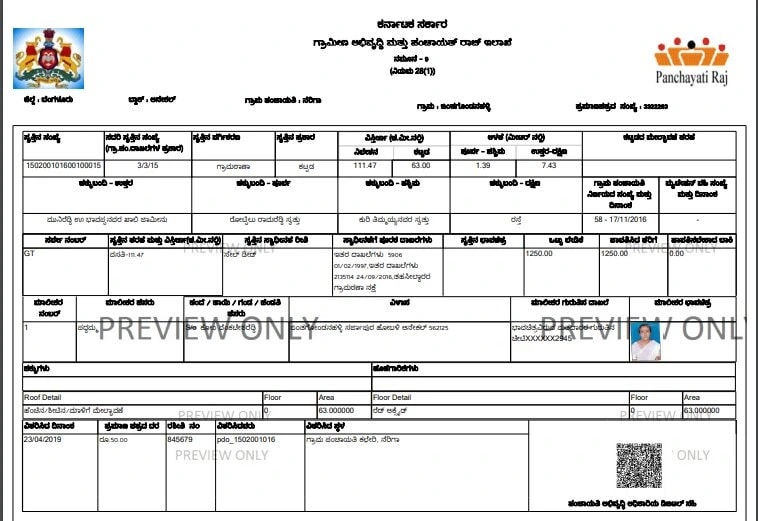

Also called the e-Khata document, Gram Panchayat (GP) issues this form. They create it for non-agricultural properties under their jurisdiction. These are used for the purpose of collection of property taxes. Here is a sample Form 9 for your understanding:

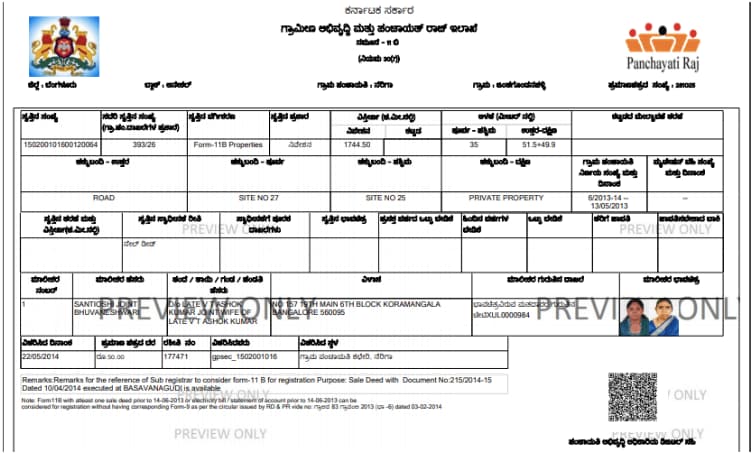

Gram Panchayats also issue this document for non-agricultural properties under their jurisdiction. GP offices extract it from the Register of Demand, Collection and Balance of Land and Building. Here is a sample Form 11 for your understanding:

These documents help in streamlining property tax, registration, and transactions within the E-Swathu framework. Here is how they are used:

Gram Panchayats use both these forms for collecting property tax

These documents make it necessary for the owners of non-agricultural properties to pay taxes

These documents are also mandatory for property registration

You also require these documents when selling property

Follow these simple steps to create Forms 9 and 11:

Visit and log in to the E-Swathu Karnataka portal

Choose the 'Addition of New Property Details' option from the menu

Enter the required details and click on the 'Ulisu Aasthi' button

Click on the ‘Save’ button

Click on the ‘Owner’ tab and fill in the required details

Upload the necessary documents and provide information like Gram Panchayat coordinates, rights, liabilities, and survey number

Provide additional registration and electricity details for Form 11

Click on the ‘Save’ button

Form 9 or Form 11 will be created

Click on the application number and select the 'Karyadarshi Anumodanege Sallisu' option to proceed further

Click on the ‘Forward’ button to get the forms

You need to meet certain conditions for the issuance of these documents. You can get Form 11 based on Form 9, but your property needs to fulfil these parameters to get Form 9.

It needs to be converted by the Revenue Department under the provisions under the Karnataka Land Revenue Act of 1964

The sanctions and approvals for plans under the Town and Country Planning Act must be in place

The property needs to be verified by the tehsildar, and its location must fall within the jurisdiction of the gram thana

It needs to be issued to the beneficiaries of the Ambedkar, Basava, and Indira Awaas Yojana

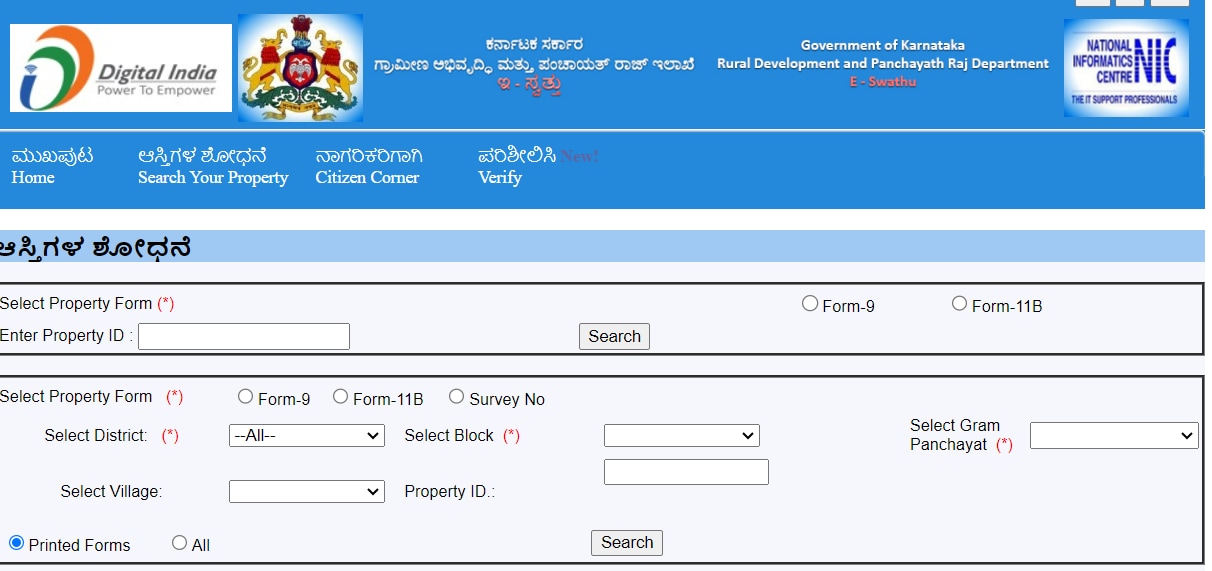

You can check property details and Form 9/11 by following these simple steps:

1.Visit the official website of the E-Swathu portal of the Karnataka government

2.Click on the ‘Search Your Property’ option on the main menu

3.Select either Form 9 or Form 11B

4.Select the District, Village, Block, Gram Panchayat, and Property ID

5.Click on the ‘Search’ button to get details of the concerned property

This user-friendly online platform allows you to check your property details effortlessly. Follow this process:

Visit the official portal of E-Swathu of the Karnataka Government

Click on the ‘Reports’ tab on the homepage from the ‘Verify’ tab

Choose the ‘Kaveri Reports’ option from the dropdown menu

Select from Property ID, Registration Number, Date-wise, Village-wise, and Abstract Report

After entering the required information, you can get details about the property’s status

Follow these simple steps to get your property documents:

Visit the official website of E-Swathu of the Karnataka government

Click on the ‘Verify’ section on the homepage

Select the ‘Verify Documents’ option from the dropdown menu

Enter your document number and click on the ‘View Document’ button

This app allows you to view and verify Form-9 and Form-11, just like the website. It also offers a property tax calculation feature. The Karnataka government is improving access to land records by providing ownership details across various subdivisions. With this app, you can get the essential information easily.

In case of any query or complaint, you can contact Rural Development and Panchayati Raj Department. The contact details for E-Swathu are as follows:

Official Address

Rural Development and Panchayat Raj, 3rd Gate,

3rd Floor MS Building,

Bangalore-560001

Contact Number: 080-22032130, 080-22372029

Email: eswathuhelpdesk@gmail.com, rdpr.info@gmail.com, eswathu.rdpr@gmail.com

Help Desk Number for Enquiries: 080-22032754

Portals to Check Land Records & EC

State Wise Land Records

- PLRS - Punjab Land Record

- Bhulekh UP Land Record

- Arunachal Pradesh Land Record

- Bhulekh Bihar Land Record

- MP Bhulekh Land Record

- Kerala Land Records eRekha

- Jammu And Kashmir Land Record

- Nagaland Land Records

- Bhuiyan Chhattisgarh Land Records

- Assam Land Records

- Dharani Maa Bhumi Telengana Land Records

- Bhulekh Maharashtra Land Record

- Delhi Land Records

- Meghalaya Land Record

- Jami Tripura Land Records

- Manipur Land Record

- Goa Land Record

Frequently Asked Questions

Who can apply for Form 9?

Individuals can apply for Form-9 if their properties fall into one of the following categories:

Property converted by the Revenue Department under the Karnataka Land Revenue Act, 1964

Property with plan sanctioned and approved under the Town and Country Planning Act

Property verified by the Tehsildar and located within the Gram Thana

Property issued to beneficiaries of the Ambedkar, Basava, and Indira Awaas Yojana

Who can apply for Form-11?

Individuals can apply for Form-11 if their properties fall into one of the following categories:

Any property that possesses Form-9

Properties already listed in the existing demand register

Where do I apply for Form-9 and Form-11?

To apply for Forms 9 and 11, visit the Panchayat Development Officer and the Gram Panchayat Secretary.

How long does it take to get Form 9 after application?

You can get a copy of Form-9 within 3 days after the fee payment and application.

Is there a mobile app for E-Swathu?

Yes, an Android app for E-Swathu is available on the Google Play Store.

How can I tell if the forms I received from E-Swathu are genuine?

You can check the genuineness of the forms by reading the 2D barcode printed on the certificate. It contains the digital signature of the Panchayat Development Officer.

How can I give feedback on the E-Swathu website?

Once you visit the E-Swathu portal, click the ‘Citizen Corner’ tab to give feedback. Make sure you enter the name and all the necessary details accurately.

Where can I find information about E-Swathu statistics?

You can check the ‘Verify’ tab on the E-Swathu online portal to access the statistics.

Is Form 9 mandatory during the sale of the property?

Yes, Form 9 is essential when you buy or sell a property in the concerned jurisdiction of the Gram Panchayat.

When did the E-Swathu initiative start in Karnataka?

The online portal was launched in the year 2021.