Explore Haryana's online Jamabandi portal for easy and digitised property transactions

The Land Revenue Department under the Haryana Government has made land records more accessible through Jamabandi portal. You can view the registration, mutation status of your land records online. Moreover, it offers comprehensive details about approved mutations and Jamabandi for any property in Haryana, allowing searches by the owner's name, Khewat number, or Khasra numbers. The portal also provides insights into revenue-related terminology and lists the required documents for property registration, promoting transparency and streamlining land record management.

Name |

Jamabandi Haryana |

Launched by |

Government of Haryana |

Objective of the Portal |

Land Records Management |

Online Portal |

jamabandi.nic.in |

Toll-free Helpline Number |

1800-180-2137 |

This innovative portal provides a faster, easier, and more transparent way to access and manage your land records. Here are the services it offers:

Check Jamabandi Nakal

Access the mutation order and check its status

Check collector rates, stamp duty, and registration fees

Use the stamp duty calculator to get an estimate of the amount payable

View cadastral maps

Access registration deeds

Check revenue court orders

Book an appointment for deed registration

This online portal is not just about checking details of land records. Here are the advantages you can enjoy:

It ensures transparency and reduces fraudulent activities related to transactions

You get the updates on land records real-time

You can get swift resolution for any complaints or questions through the redressal system

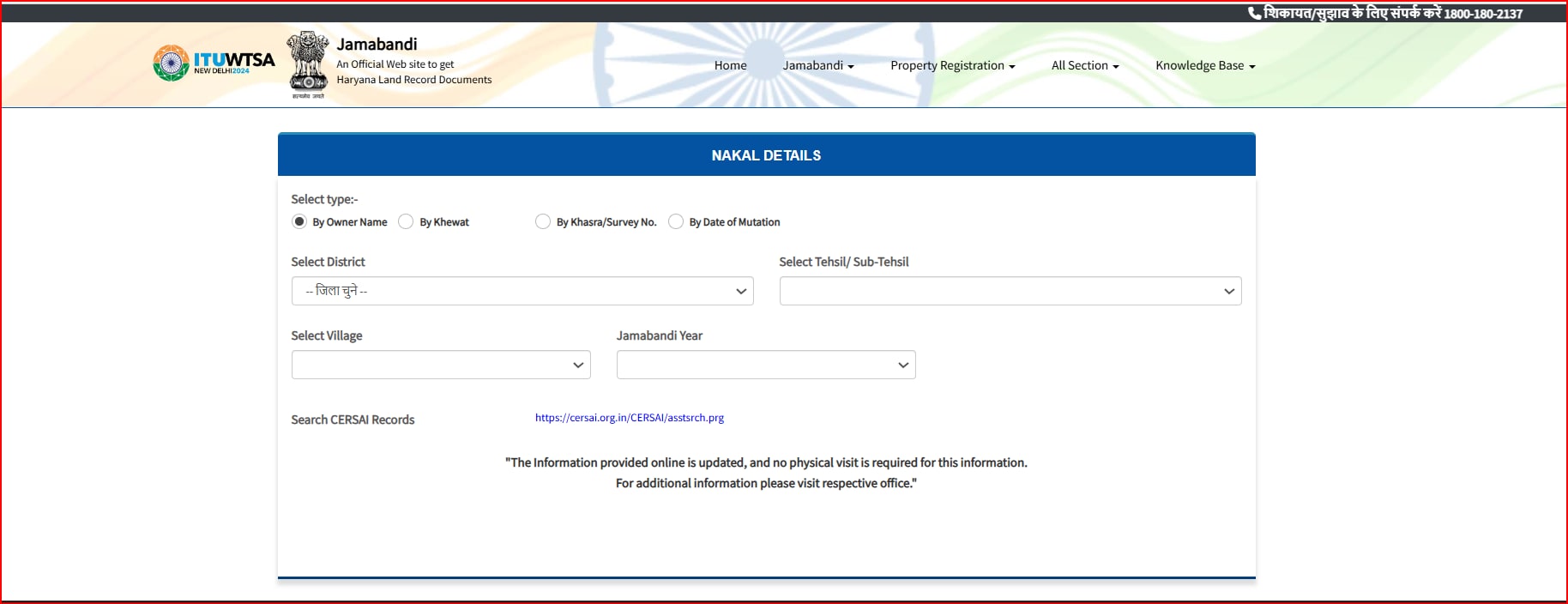

Nakal is a copy of your land records that contains details about land ownership, revenue, and more. Follow these simple steps to access Jamabandi Land Nakal.

Step 01: Visit the official Jamabandi Haryana portal

Step 02: Click on the ‘Jamabandi’ tab and choose the ‘Jamabandi Nakal for Checking’ option

Step 03: Choose the type: Owner’s name, khewat, khasra/survey number, or the date of mutation to access details

Step 04: Select the required district, tehsil or sub-tehsil, village and jamabandi year

Step 05: Enter the relevant details to access Jamabandi Nakal details

When registering your deed on this online portal, you will be required to attach some necessary documents. These include:

Proof of ownership, such as Fard of Jamabandi, certified copy of original sale deed, assessment of MC, or Mutation

Identification of the parties, including their ration card, voter card, driving licence, Aadhar card, or PAN card

ID proof of witness

Registration of documents through the power of attorney, including verification of GPA

No-Objection Certificate (NOC) from DTP under Section 7(A) of the HDRUA Act 1975

Map plan and description of immovable property

Digital photograph of building/plot

Mutation of virasat for identification of ancestral property (in case of release deed)

To check the availability of deed registration appointment slots on the Jamabandi Haryana portal, follow these steps:

Step 01: Head over to the official portal of Jamabandi, Haryana

Step 02: Select the option ‘Check Deed Appointment Availability’ from the ‘Property Registration’ tab

Step 03: Select your district, tehsil and number of days for which you want to check availability

Step 04: Click on ‘Search’

Here is how you can search for a registered deed on the Jamabandi portal.

Go to the official Jamabandi portal

Click on the ‘Property Registration’ tab present in the menu

Choose the ‘View Registered Deeds’ option

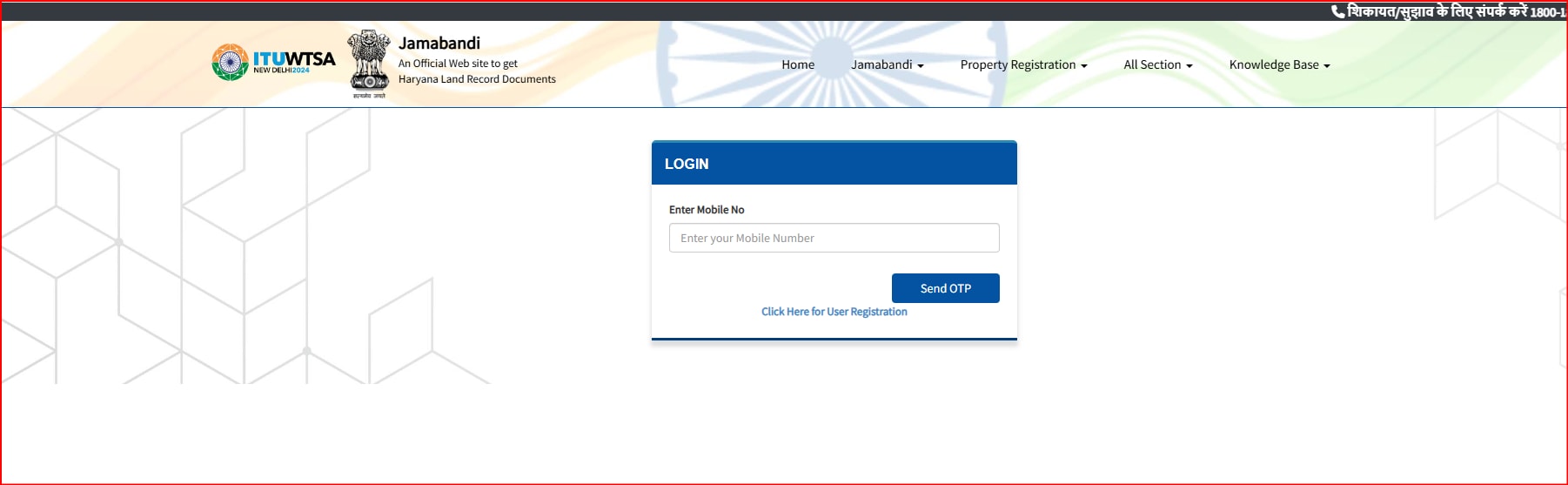

Log in using your mobile number

Input property details, such as district, tehsil, registry number, registry date, deed name, and more

Click on the ‘Search’ button to view the details of the registered deed

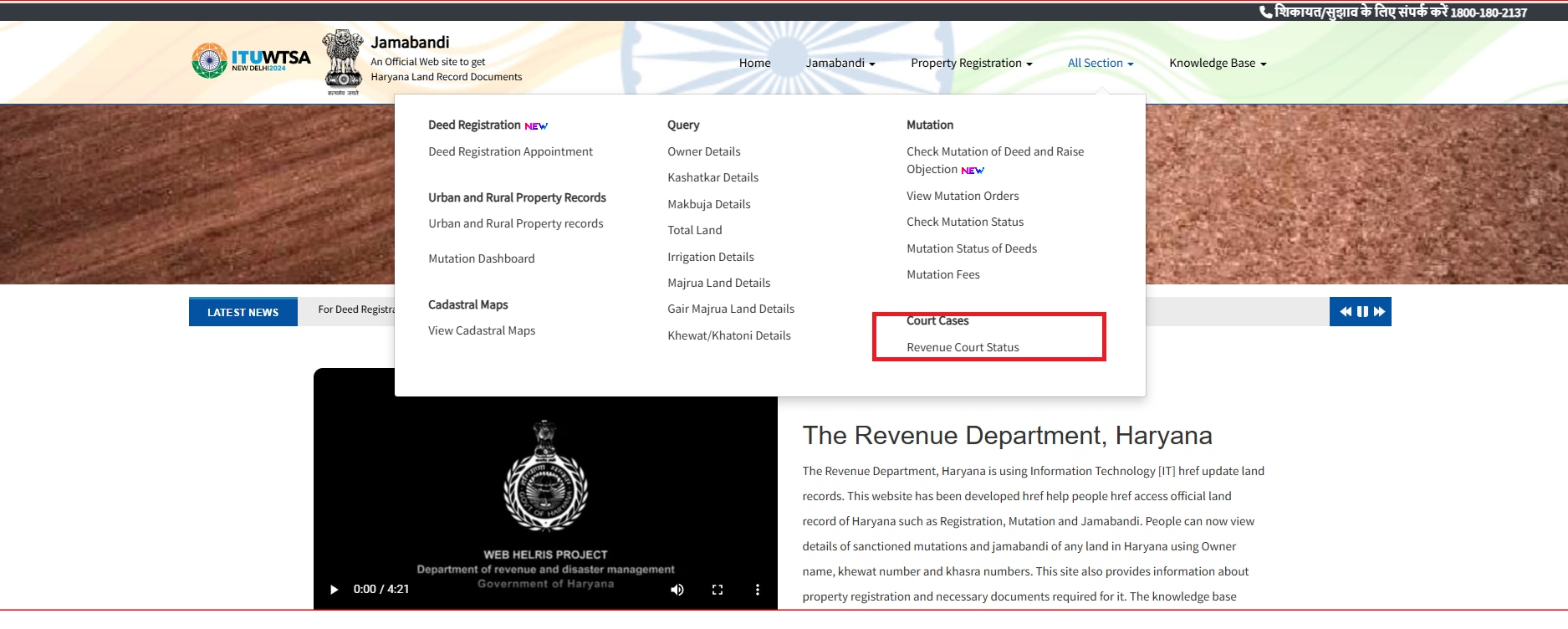

Follow the below steps to search for the court cases:

Step 01: Click on ‘All Section’ section on the homepage

Step 02: Select ‘Revenue Court Cases’

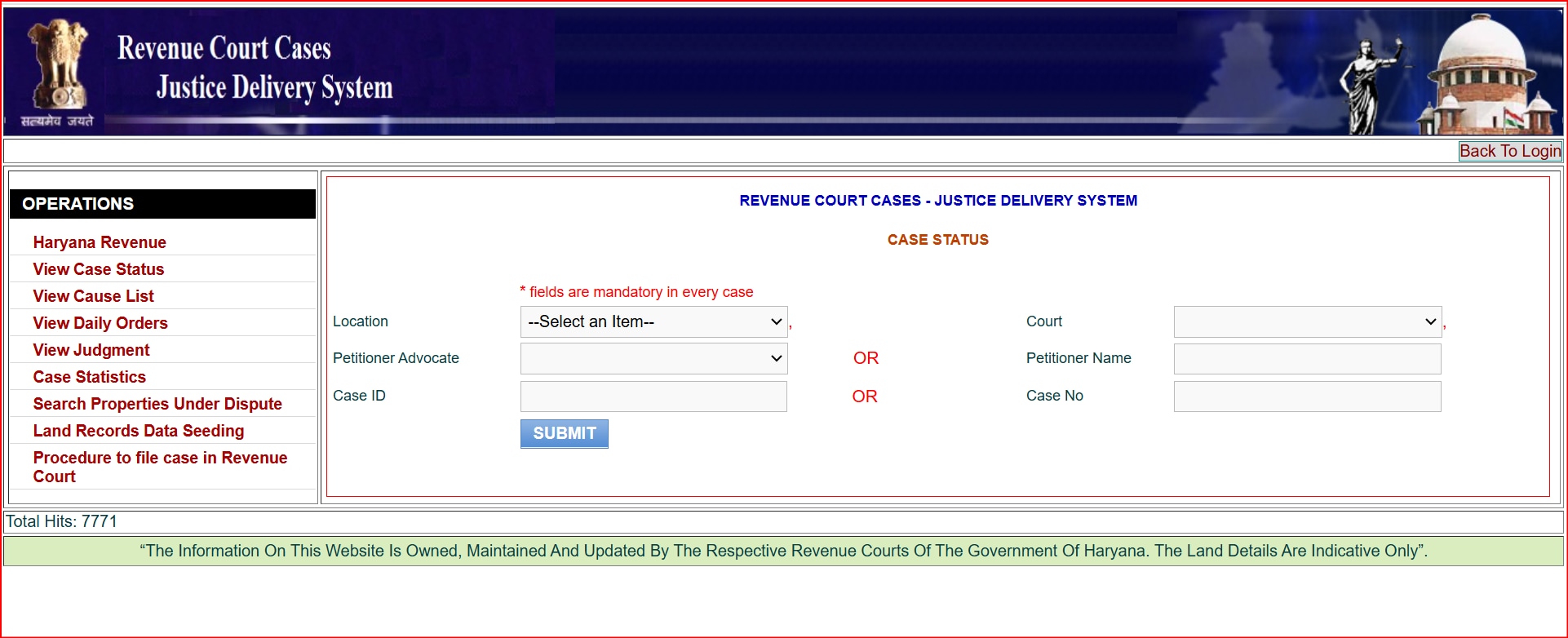

Step 03: You will be redirected to https://hryrevenuecourts.gov.in/, the official website of ‘Revenue Court Cases Justice Delivery System’

Step 04: Click on the appropriate option depending on whether you want to search for revenue court cases or civil court cases.

Step 05: You may need to provide details such as location, case ID, date of filing, etc

Step 06: Click on ‘SUBMIT’

The system will display a list of cases matching your criteria. Click on the relevant case to view more details. If available, there will be an option to download the court order associated with the case.

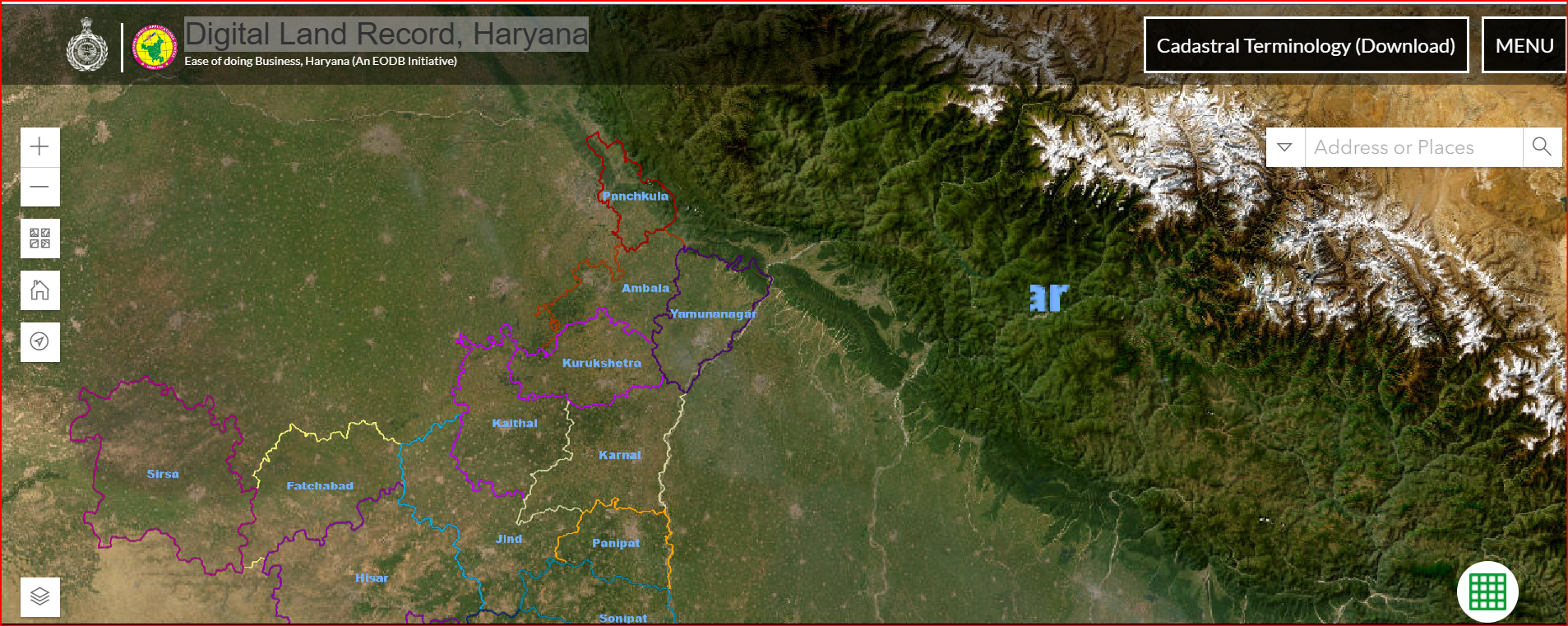

This innovative portal also comes with a digital explorer, allowing you to check your property online. Follow these simple steps to access the cadastral map.

Step 01: Visit the official Jamabandi portal

Step 02: Click on ‘All Section’

- Step 03: Select the ‘View Cadastral Maps’ section

Step 04: You will be redirected to the official website of ‘Digital Land Record, Haryana’ https://hsac.org.in/eodb/

The map will be displayed on your screen. This process allows users to easily access detailed cadastral maps that show land boundaries and ownership information, enhancing transparency and accessibility in land management in Haryana.

Mutation refers to the changes made to land records concerning the ownership and title. A mutation register contains records of all these changes. Check out the fees applicable for mutation requests:

Fee for the acquisition of an interest or right by a registered deed or an order of the court: ₹200

Service charges: ₹50

If you requested any changes in land records, you can check them on the portal. Follow these steps to view Jamabandi mutation orders.

Step 01: Go to the official website of Jamabandi

Step 02: Click on the ‘All Section’ option on the homepage

Step 03: Select the ‘View Mutation Orders’ option

Step 04: Provide your mobile number and the OTP received on it

Step 05: Enter your district, tehsil, and village from the menu

Step 06: Input mutation number and mutation date

Step 07: Submit the details view the mutation order

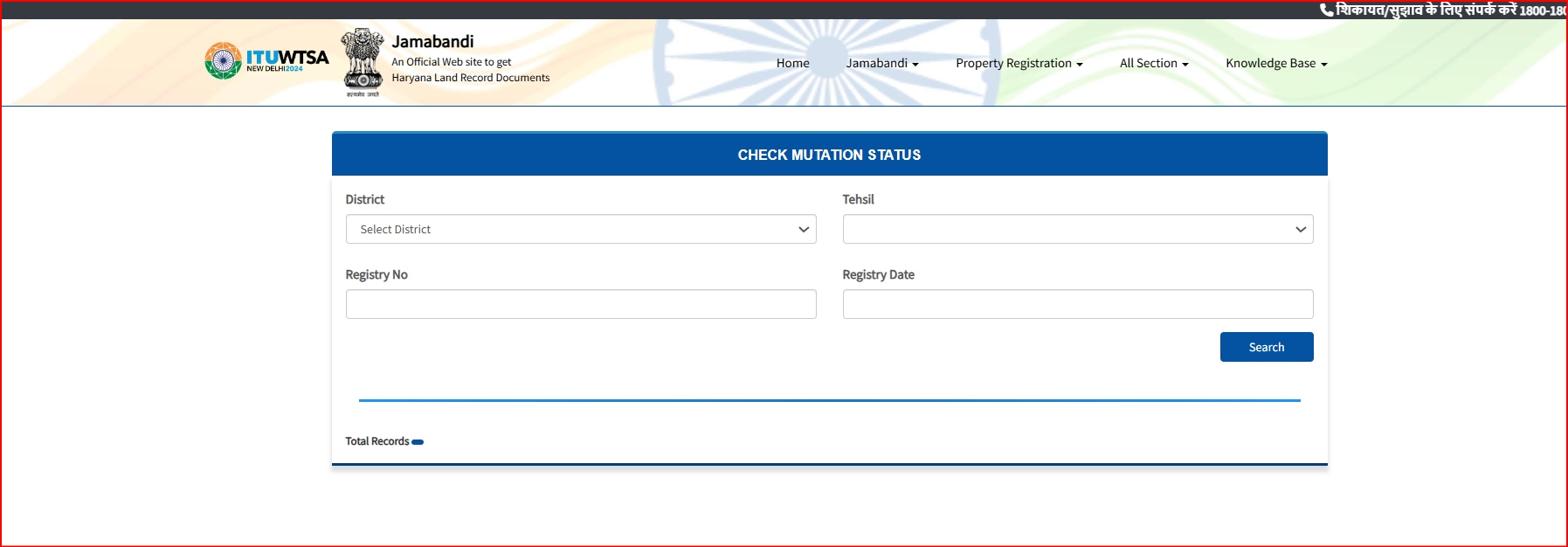

Once you have requested these changes, you can check online whether it has been updated. Here are the steps to follow.

Step 01: Visit the official Jamabandi portal

Step 02: Click on the ‘All Section’ option on the menu available on the homepage

Step 03: Select the ‘Check Mutation Status’ section

Step 04: Select your district and tehsil. Enter your registry number and date, and click on the ‘Search’ button to check the status

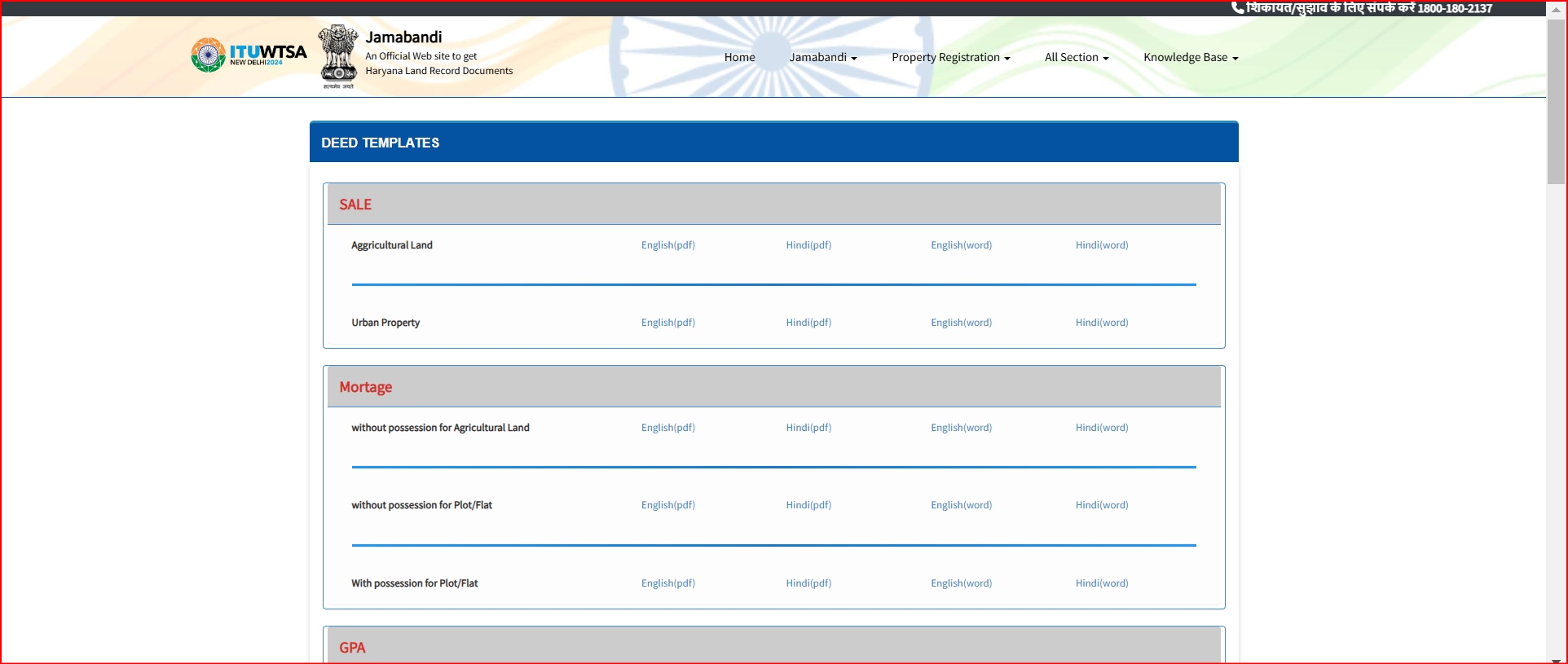

To register an immovable property in Haryana through the Jamabandi portal, follow these steps:

Step 01: Visit the Jamabandi website

Step 02: Navigate to the ‘Deed Templates’ section and download the appropriate deed (e.g., sale deed, gift deed)

Step 03: Complete all necessary details in the deed template. Ensure that all parties involved have signed the document.

Step 04: Obtain an E-Stamp from the Haryana E-GRAS (Online Government Receipts Accounting System) portal after calculating your fees

Step 06: Click on the Property Registration tab on https://jamabandi.nic.in/ and select ‘Check Deed Appointment Availability’. Choose your district and tehsil, then select a suitable date and time slot for your appointment.

Step 07: Gather required documents

Step 08: On your appointment date, go to the Sub-Registrar's office with all required documents and E-Stamp details. The registration clerk will forward your deed to the Sub-Registrar for processing.

Step 09: The Sub-Registrar will verify documents, capture biometric data, and register the deed in the Haryana Land Record Integrated System (HARIS).

Step 10: A registered copy of the deed will be printed and provided to you

Step 11: After registration, you can view your registered deed on the Jamabandi portal

Before you finalise a land deal, it is crucial to calculate the stamp duty you will have to pay. You can compute it by following these simple steps.

Step 01: Visit the official Jamabandi website of the Haryana Department

Step 02: Click on the ‘Property Registration’ option and select the ‘Stamp Duty Calculator’ category

Step 03: Enter the transaction value and select whether the property lies within the Municipal Corporation limit or not

Step 04: Select your gender and click on the ‘Calculate’ button to view the amount you will have to pay as stamp duty

Take a look at the contact details, if you want to reach out to the Revenue Department of Haryana:

Official Address:

Jamabandi Haryana

Revenue Department,

Government of Haryana,

Haryana Civil Secretariat,

8th Floor, Chandigarh - 160001

Office Number: 0172-5059102

Toll-Free Number for Enquiries: 1800-180-2137

Portals to Check Land Records & EC

State Wise Land Records

- PLRS - Punjab Land Record

- Bhulekh UP Land Record

- Arunachal Pradesh Land Record

- Bhulekh Bihar Land Record

- MP Bhulekh Land Record

- Kerala Land Records eRekha

- Jammu And Kashmir Land Record

- Nagaland Land Records

- Bhuiyan Chhattisgarh Land Records

- Assam Land Records

- Dharani Maa Bhumi Telengana Land Records

- Bhulekh Maharashtra Land Record

- Delhi Land Records

- Meghalaya Land Record

- Jami Tripura Land Records

- Manipur Land Record

- Goa Land Record

FAQs on Jamabandi Haryana

How to check information on Jamabandi Portal?

To check information on the Jamabandi Portal, visit the official site and select the ‘Jamabandi Nakal for Checking’ option. You can search using the owner's name, Khewat number, Khasra number, or date of mutation. Enter the required details to access land records and property information.

Is mutation and Jamabandi the same?

No, mutation and Jamabandi are not the same. Jamabandi refers to the record of rights for land ownership, while mutation is the process of updating land records to reflect changes in ownership or land use. Both are essential for maintaining accurate land records in Haryana.

Is Jamabandi Haryana proof of ownership?

Yes, Jamabandi in Haryana serves as proof of ownership. It contains detailed records of land ownership, including the owner's name and property details, making it a crucial document for establishing legal ownership of land

How to check the plot registry online in Haryana?

To check the plot registry online in Haryana, go to the Jamabandi portal. Enter your mobile number to receive an OTP for verification, allowing you to access the registry information easily.

Can I access old Jamabandi records online in Haryana?

Yes, you can access old Jamabandi records online in Haryana. The portal allows users to view historical records by selecting the respective year and entering relevant details like owner name or Khewat number.

How can I check the collector rate on Jamabandi Haryana?

To check the collector rate on Jamabandi Haryana, visit the portal and navigate to the relevant section that lists collector rates. You may need to select your district and other details to view specific rates applicable to your area.

How do you get a verified copy of Nakal on Jamabandi Haryana?

To obtain a verified copy of Nakal on Jamabandi Haryana, visit the official website and select ‘Jamabandi Nakal for Checking’. Enter necessary details such as owner name or Khewat number, and follow prompts to download or request a verified copy from local authorities if needed.

Can I check property tax on the Jamabandi Haryana portal?

Yes, you can check property tax on the Jamabandi Haryana portal. The platform provides access to various property-related information, including tax details associated with specific properties by entering relevant identifiers like owner name or Khewat number.