Saying that the results of the parliamentary elections were stunning would be an understatement. The Bharatiya Janata Party led by Narendra Modi secured a historic majority in the lower house. A well-crafted communication strategy and efficient delivery of economic inputs to deserving beneficiaries helped Modi trump competitors for a second consecutive term. The National Democratic Alliance’s first five years were marked by several reforms like Goods and Services Tax (GST) and Insolvency and Bankruptcy Code. However, several reforms that were likely to be taken up were put on the backburner. In its second term, with a bigger majority, the Government is expected to initiate many some much-needed reforms.

Agricultural reforms

Indian media was awash with reports of rural distress a few months ago. With more than half of the population engaged in agricultural activities contributing just 18% to the GDP, reforms in the agricultural sector cannot be ignored. Agriculture is a state subject, the Central Government has limited powers to ensure the execution of model laws. The Government has a stated aim to double farmers’ income by 2022. The aim needs to be backed by supply-side and demand-side reforms. The Government has tried to free farmers from the shackles of Agricultural Produce Marketing Committees, which have become a hub of corruption, by promoting e-National Agriculture Market. The Government has taken a step in the right direction by promoting a cluster-based approach in the Union Budget 2019. Around 100 new economic clusters with a focus on Bamboo, Honey and Khadi would be set up under the Scheme of Fund for Upgradation and Regeneration of Traditional Industries (SFURTI). Besides the announced steps, reforms in agricultural marketing to boost exports is expected to be taken up by the government.

Land Reforms

Land is an emotive subject in India, and the government had to beat a hasty retreat in its first term when it tried to bring land reforms. Without the availability of large tracts of land for industry, the government cannot hope to spur economic growth. Arbitrary acquisition of land, without proper rehabilitation or compensation, has made people suspicious of land acquisitions. Between 1947 and 2004, about 25 million hectares of land has been acquired for various purposes in India. The Government needs to nudge states to bring in laws similar to model land acquisition law, which should be framed by the Central Government. The Central Government can create an enabling legal infrastructure to help acquisitions for projects of national and strategic importance.

Labour Reforms

In its second term, the current dispensation is expected to bring in reforms in the laws that guide labour in India. Experts opine that to unleash rapid industrialization and attract foreign capital in manufacturing, the government will have to ease labour laws and simplify compliance. Large companies will have to be given the freedom to hire and fire workers according to their requirements. The laws that govern labour and wages are excessively complex and tend to be stacked against factory owners. There are separate labour laws for differing sectors like cigarette manufacturing, newspapers, working journalists, etc. This has led to 37 central laws and six amendments dealing only with labour with six laws that relate to wages alone. The Government is expected to curtail this maze and come out with simpler labour law.

Infrastructure Reforms

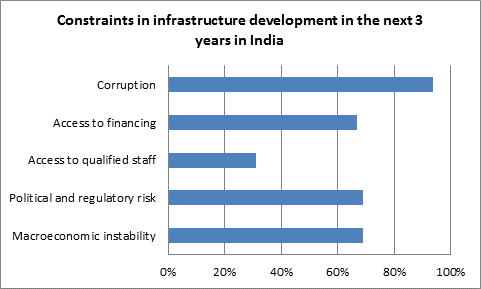

The Prime Minister had announced that the Government will spend around $1.5 trillion to develop India’s creaking infrastructure. World-class infrastructure, including airports, roads, ports and railways, is required to develop a vibrant economy. The Government does not have complete resources to develop infrastructure alone. Private sector investments will have to support government spending to get optimum results. The Government is likely to bring predictability to the regulatory environment and draft a law that would take into account innovative means of financing. The Union Budget proposes to attract private capital in railways to fulfil the requirement of Rs 50 lakh crore investments by 2030. The budget signals towards an aggressive push to develop infrastructure on a war footing, but to achieve the target the government will have to free up the sector from legacy laws.

Source: World Economic Forum

Financial Sector Reforms

A bulk of Indian household savings is still invested in real estate and gold. However, the process of financialisation of savings has started and the government needs to support it through policy and incentives. The Indian financial sector functions in silos, which complicates the process of investing. Financial sectors like insurance, banking and equities have different regulators and lack a seamless strategy. Consumers are increasingly displaying convergence of investment options. For instance, an insurance plan, a pension plan and a mutual fund, all are essentially vehicles of savings and investments packaged differently, with varying costs and disclosures. All three tools to create long term wealth, but have different regulators. The Government is likely to push reforms in the financial sector to create a unified, seamless investment environment.

Direct Taxes Reforms

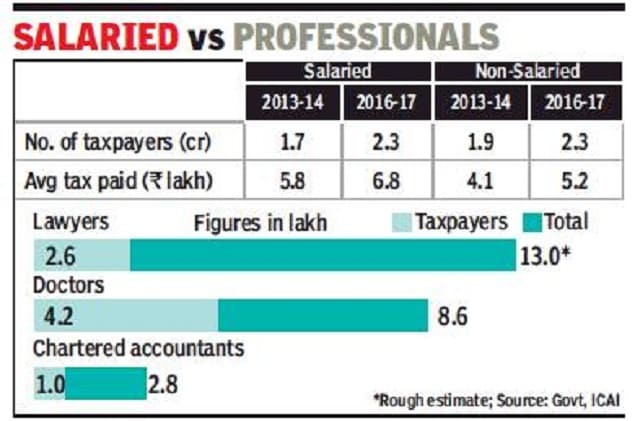

It is widely known that a small number of people pay a bulk of taxes and the government has been trying to widen the tax base. In 2017-18, only 46.7 million individuals and 1.1 million firms paid income tax, leaving a huge chunk outside the tax network. The Government had initiated the process to consolidate different direct taxes in its first term. A task force was formed to draft new legislation that would amend the laws dealing with direct taxes — the Income Tax Act, 1961, and the Wealth Tax Act, 1957 — into a single and simple law. Additional reforms are needed to make tax laws predictable, reduce the cost of compliance and minimize exemptions that serve a single community. The budget proposes to move to ‘faceless assessment’ for tax filing which is likely to reduce corruption.

Source: Times of India

Conclusion

Initiating reforms in India is better said than done. With a fractured polity, a heterogeneous society and groups with clashing interests, the Government will have to walk the tight rope in order to bring a change. However, reforms can be pushed by taking everybody on board through consensus building and rigorous discussions.

Head to the Bajaj Markets website to read more about the key highlights of union budget 2019.

“Bajaj Markets, from the house of Bajaj Finserv is an exclusive online financial supermarket for all your personal and financial needs. Loans, Insurance, Investment and an exclusive EMI store, all under one roof – anytime, anywhere!”