The lead up to every budget is full of expectations, promises, and concerns. For the Budget 2020, India waits with bated breath. The central government had a dramatic 2019. The BJP government came back to power, but then important government functionaries - Sushma Swaraj and Arun Jaitley - met their unexpected demise in the same month. The year ended with headlines about slowing growth rates and the controversy over the Citizenship Amendment Act. In 2020, the government wants to start things off on the right footing. The goal is to boost growth in the sagging sectors of the economy, give tax relief to the common man, get back the support of the public, and lay the groundwork for economic recovery and growth for the rest of the government’s term.

Below are 5 budget expectations for 2020

1) Aviation FDI

Jet Airways - one of the biggest airlines in India - has not flown a single flight since April 2019. This is because Jet Airways faced an extreme shortage of funds and could not afford to fly anymore. Air India has had similar issues over the years. In budget 2020, the government is looking to further disinvest from Air India. The government is also looking to allow foreign investors to take governing stakes in Indian airlines. Aviation FDI - currently capped at 49% - might be increased to 100%. Foreign players currently only have Maintenance, Repair, and Overhaul (MRO) rights - in the latest budget, the government might finally allow foreign investors to take Substantial Ownership and Effective Control (SOEC) of Indian airlines.

2) Tax cuts

A Standing Committee in Lok Sabha has recommended changes in the income tax rates. The committee suggests cutting down the tax on income up to Rs. 10 lakhs to 10%, bringing down the tax for individuals earning between 10 lakhs to 20 lakhs to 20% from the current 30% rate, and reserving the 30% tax liability only for those earning more than Rs. 20 lakhs per annum. There is still an intense debate underway about this. There are those who believe that since less than 30 million Indians pay income tax, an income tax reform will not touch the masses. Instead, committed investment in infrastructure will have a multiplier effect and benefit many more people. Only the budget speech on the 1st of Feb will reveal which direction the decision-makers have swayed in.

3) Abolishing LTCG Tax

Long Term Capital Gains are the bread and butter of the equities market. In 2018, much to the industry’s frustration, the government introduced a Long Term Capital Gains Tax - taxing the income arising from the purchase/sale of equities. Income up to Rs. 1 lakh was exempt from this tax, after which an effective tax rate of 12% was levied. In Budget 2020, the equity market expects the government to do away with the LTCG tax. This, according to industry veterans, will revive consumer sentiments and boost growth. Whether the budget heeds to their demand remains to be seen.

One market instrument that is exempt from the LTCG tax is ULIPs (Unit Linked Insurance Plans. ULIPs, which are part-investment, part-insurance products, hold the privileged EEE (Exempt - Exempt -Exempt) status. This means that not only is the principal investment exempted from taxation, but the accumulated amount and the maturity proceeds are tax-free as well. Even if Budget 2020 doesn’t turn out as expected, you can do some effective tax-planning by investing in instruments like ULIPS. You can consider the ULIPs available on Bajaj Markets for your first ULIP investment. You have the flexibility of choosing your plan as per your current needs and future goals. You can pick from Retirement Plans, Child Plans or Investment Plans. Invest in ULIPs on Bajaj Markets now and avail the dual benefits of tax-savings as well as high returns!

4) Budget will incentivize retirement planning

Currently, salaried Indians can invest up to Rs. 50,000 every year in the National Pension Scheme (NPS) and have the entire amount count towards their tax deductions. In the Budget 2020, the government might increase this to 1,00,000 per annum. People tend to invest in schemes that decrease their tax burden - therefore a double tax relief will incentivize many to start keeping away money for retirement.

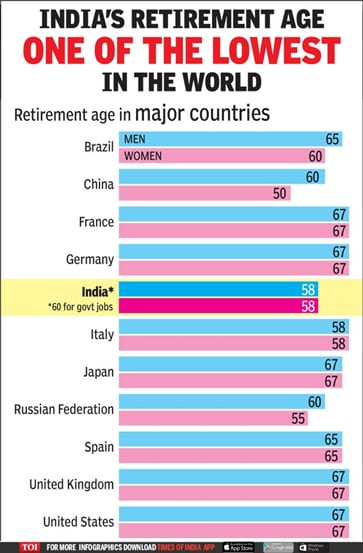

Indians tend to retire sooner than most of the world - thus making financial planning even more important.

5) What to NOT expect

The article has talked about decisions and reforms that are likely to be undertaken in this year’s budget. Turning our attention in a different direction, let’s look at one decision the government is unlikely to take. According to reports, the government is not very inclined to give a significant cash infusion to Public Sector Banks (PBS) in the budget of 2020. Rather, the government hopes the banks can raise funds for themselves by lending from the market and by recovering their bad loans. According to the Press Trust of India, Public Sector Banks realize that they may be on their own in this fiscal year. Therefore, they have kickstarted disinvestments from non-core businesses to streamline their revenue models. SBI is diluting a percentage of its stakes in its divisions like SBI Cards and Payment Services Ltd and UTI Mutual Fund. Other PSBs are taking similar steps to raise capital.

It is safe to say that Budget expectations are high. Given the state of the economy, the 2020 budget could have the chance to put India back on the right track once again. Implementing the aforementioned changes could well do the trick. It leaves to be seen if Budget 2020 lives up to expectations.