India’s Finance Minister Nirmala Sitharaman, is supposed to take the center stage on February 01, 2020, as she would present Budget 2020. In wake of the recent economic slowdown, everyone will be tuned in to understand the offerings of the upcoming budget.

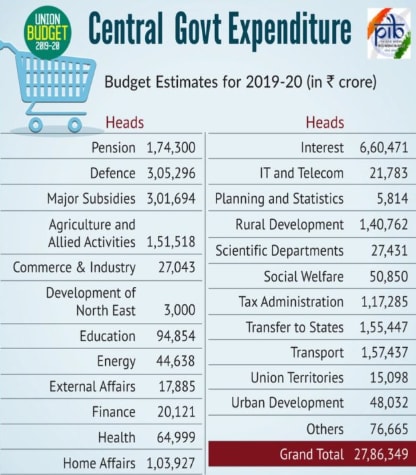

Source: Press Information Bureau

In order to increase consumer spending and thereby revitalize the economy, a number of taxpayer-friendly breaks are being pitched. Here are a few financial ideas with regards to income tax worth considering when looking forward to the upcoming Budget.

Suggestion 1 - Put an end to paying taxes thrice on capital in India

In India, as many as 5 taxes are levied on capital. Corporate tax, capital gains tax, dividend distribution tax, securities transactions tax as well as tax on the dividend beyond INR 10 Lakhs. Firstly, the corporate tax on profits is paid by companies. Then the dividend distribution tax is levied on the dividend paid to shareholders from the profits post taxation. Lastly, a taxpayer paying personal income tax has to pay tax if the dividend is beyond INR 10 Lakhs. This capital market taxation becomes a tedious process. Removing dividend distribution tax can help boost capital, compensating for any revenue loss which will result in an eventual growth.

Suggestion 2 - Make savings meant for buying a house tax-free

For many families, buying a house remains one of the top-most priorities. However, Indian families often find themselves without sufficient savings to invest in buying a house. How can people be encouraged to save money for the purchase of their dream home? A special savings account dedicated to investment towards the down payment or outright purchase of a house is a good idea. If the user of such an account is given the opportunity to invest up to INR 5 Lakhs per annum and receives an income tax break on the said contribution, homeownership would significantly increase in the coming years.

Suggestion 3 - Encourage real-estate investments by providing tax exemption on rental income

The real estate sector has had to deal with high inventory levels with no significant asset building to balance. How can Budget 2020 address this issue? It would need to begin with the rental income of taxpayer. The rental income in today’s markets, is relatively quite low and thereby, taxation on this income doesn’t promise healthy investment returns. What if the rental income is exempted from tax? This will then lead to more people investing in real estate. In Tier 1 cities, the demand for properties will increase. Broadly speaking, this will positively impact employment, demand for raw materials and household items, and in turn Government revenues. Increase in such benefits means there’s an increase in GST collection and stamp duty, thereby generating space for evident asset building in the market.

Suggestion 4 - Income tax deduction on health insurance should have an increased limit

With a drastic increase in diseases and disorders resulting from rising climate issues, health insurance is now dearer than ever to many taxpayers. Budget 2020 must bring the deduction limit for health insurance from INR 25,000 to INR 50,000 at the least under section 80D of the Income Tax Act. Moreover, senior citizens who are dependent parents should be receive incentives in the form of a rise in health insurance deduction limits from INR 50,000 to INR 75,000. The GST rate for personal insurance is currently at 18% which should be brought down, too.

Since the importance of health insurance has rung louder or clearer, it is never too early to invest in a protective cover for you and your loved ones. You can opt for the Bajaj Allianz Health Insurance plan on Bajaj Markets and avail a whole host of benefits, apart from tax-savings! You can avail everything from high sums insured of up to Rs. 50 lakhs at nominal premiums to cashless facilities at a wide network of over 6500+ hospitals across the country. You can take advantage of swift claim settlement within 60 minutes and free health check-ups too! Avail the dual benefits of tax-savings and financial protection by investing in a health plan on Bajaj Markets now.

Suggestion 5 - Tax relief on interest income for all taxpayers

For individual taxpayers, common investments come in the form of fixed deposits and small savings schemes. The fall in interest rates drastically affects their savings. If tax exemption is provided on bank deposits for taxpayers (beyond senior citizens only), this will provide relaxation to all taxpayers alike.

Suggestion 6 - Separate deduction for educational expenses

Many households in India struggle with the expenses for their child’s education. Currently, the growth rate of educational expenses is 12%, making it financially the most burdensome issue after healthcare. Most parents resort to investments in Provident Fund or Public Provident Fund in order to pay for their children’s education. Budget 2020 can introduce the provision of tax benefits on such saving instruments to help maximize the savings of Indian parents. Moreover, a new section consisting of a separate deduction on educational expenses should be considered, given the rise in educational costs. Currently deductions on expenses are clubbed with a variety of deductions under Section 80C, which has an overall limit of Rs. 1.5 lakhs. This will ensure that the parents start saving for the educational fees easily and in a stress-free manner.

Suggestion 7 - Reduce the TDS (Tax Deducted at Source) rate

For professionals and those providing technical services, the current TDS rate of 10% proves to be quite the financial burden. Reducing their disposable income at hand, the current TDS limits the purchasing power of many consumers, a feat that India is desperately in need of, to revitalize its economy. Moreover, this only increases the burden of applying for refunds, since most taxpayers do not fall in that higher tax bracket. Thus, a reduced TDS rate of 5% would do a whole lot of good for India’s taxpayers.

The aforementioned ideas may appear to be far-reaching, but in the long run, they will prove fruitful if implemented in Budget 2020. It waits to be seen if Budget 2020 will live up to taxpayers’ expectations and provide some much-needed relief.

Bajaj Markets, from the house of Bajaj Finserv, is an exclusive online supermarket for all your personal and financial needs. We understand that every individual is different and thus when you plan to achieve your life goals or shop for the gadget of your dreams, we believe in helping you Make it Happen in a few simple clicks. Simple and fast loan application processes, seamless, hassle-free claim-settlements, no cost EMIs, 4 hours product delivery and numerous other benefits. Loans, Insurance, Investment, and an exclusive EMI store, all under one roof – anytime, anywhere!