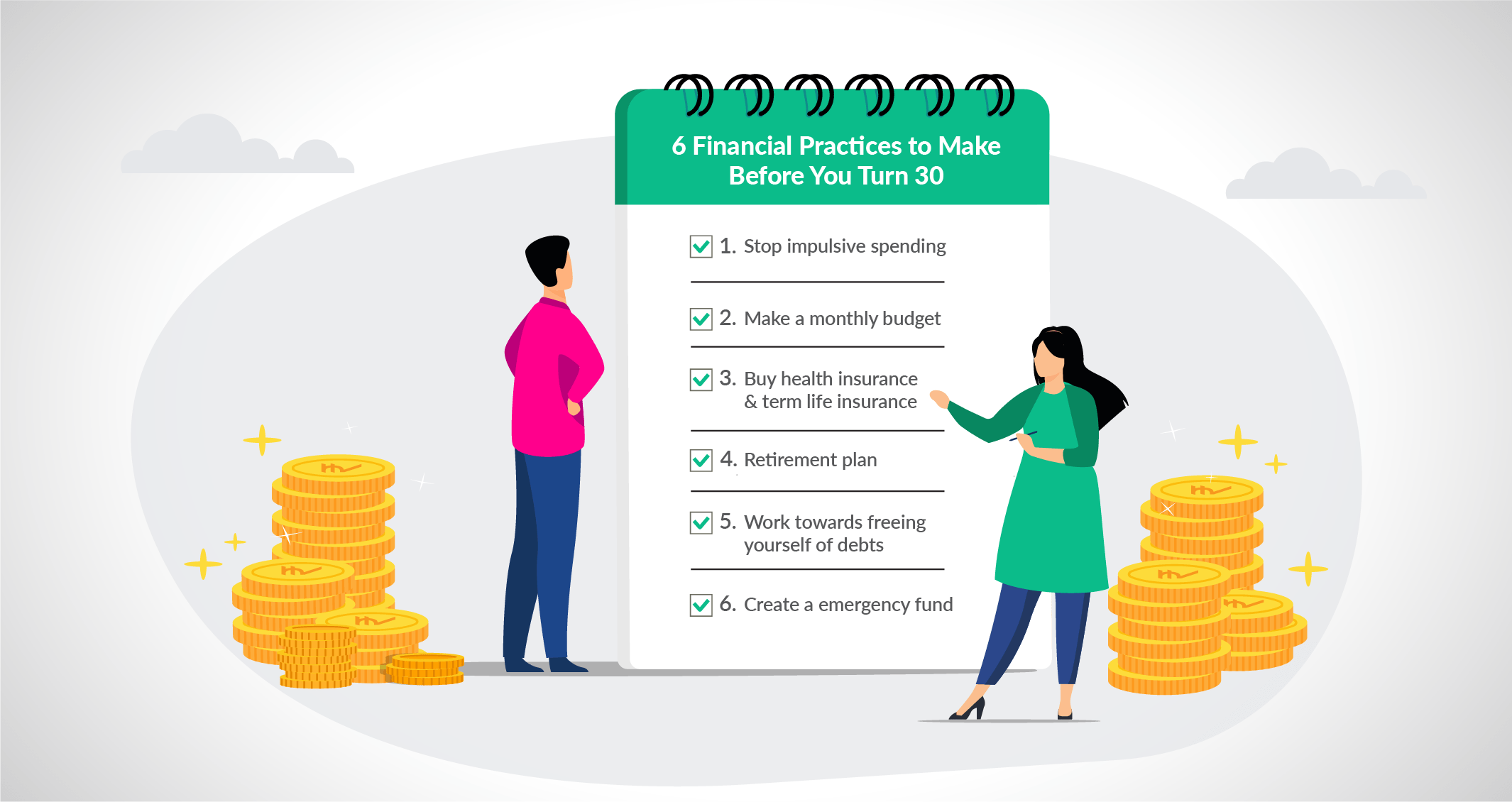

6 Financial Practices to Make Before You Turn 30

If you come to think of it, turning thirty marks an important milestone in terms of your career. It marks the halfway journey to retirement for most people. To have a retirement free of financial troubles and worries, one needs to begin handling finances as smartly and efficiently as possible, and as soon as possible. Don’t have a clue of how to go about doing it, where to begin and what to prioritise? Don’t worry! We’ll walk you through 6 financial practices to make before you turn 30.

1. Stop irresponsible and impulsive spending

With the dawn of the era of internet shopping and credit cards, it has become ever more difficult to keep away from indulging in impulsive shopping. Try to reason out with yourself if you are really in need of a certain product or service. Better still, don’t sign up for notifications and offers from shopping websites and offline stores. It will allow you to not fall prey to the clever sales and marketing strategies of companies. Not to mention the time it will save you, and we all know that time is money too.

2. Make a monthly budget and stick to it

To have a clear idea of where you stand with your monthly spendings, make a budget, and swear to live by it. This is the practice that will work wonders for your financial health in the long run and you will have a clear understanding of how your finances are structured and what changes can be made to make them more efficient. An app offering a monthly budget tracker, or a diary can be kept handy for this purpose.

3. Buy health insurance as well as term life insurance

This is something that cannot be re-iterated enough. Investing in small chunks towards a health and term life insurance will be the smartest move to protect your family and yourself against mammoth unforeseen financial risks. Moreover, the earlier in life you take insurance, the less you will have to pay up as premium.

4. Get serious about a retirement plan

Time is fleeting and therefore you must start thinking about your retirement. Visualise the kind of lifestyle you would want and calculate an estimate of how much money you should be saving every month, taking into consideration inflation rates. When do you want to retire is something that needs careful thought and practical insight. According to your vision, talk to an expert about how you can invest in a retirement plan to have a comfortable lifestyle in the final years of your life.

5. Work towards freeing yourself of debts

Have you taken one or multiple loans that have left you in a debt trap? Do you keep wondering when your instalments will get over? Take a day out to assess your debts. Take advice from your lenders as to how much time you still need to repay in full and whether the process can be accelerated. If you think you can manage to pay a bigger sum in instalments, approach your bank for the same.

6. Create a supplementary emergency fund

To hope for the best but to be prepared for the worst is the mark of intelligence and far-sightedness in a person. Do not hesitate to make a supplementary emergency fund if you are able to do so. It will give you extra protection and safety against unprecedented risks and financial potholes in life.

Conclusion

Living from pay-check to pay-check might not look troubling to youngsters, but it can only take you so far. To be able to maintain your lifestyle and comforts you need to get serious about money management right from the time you begin to earn. Saving up little by little and practicing one step at a time will not feel burdensome and you will never have a worry throughout your life.