Banking – Then Vs Now

From Barter Systems to Stones to Coins to Notes to Digital Currencies to Crypto Currencies. Banking has come a long way ahead.

Back in the day, everything had some monetary value. You must have heard of the barter system, where you can exchange goods and services you want with any of your goods and services. However, when humans evolved; and everyone started to farm and hunt on their own, this system broke down, but somehow it created a shared belief and a necessity of having a piece of metal or a stone or a paper that can hold some monetary value. You get the commodity or the service that you need by exchanging it.

After the barter system became obsolete, the coins forged out of specific metals (gold & silver) gained monetary value. Hence, the concept of money came into existence. These coins helped the Roman empire stretch its boundaries beyond their imaginations, establishing the long-lasting power of money. During that time, citizens needed a place to store their accumulated coins or lend some money when they needed it, in the form of a loan, and thus “banks” came into existence.

Fast forward to the modern days of the 21st Century, you can now transact at your fingertips. You have thousands of options to invest your money or to earn money.

Let’s look at some of the points that differentiate banking from then to now:

Safety of Your Money

The main reason for banks coming into existence was the need for a place where residents of the societies can safeguard their money. Before banks existed, people stored their money in the underground vaults of temples. Today you don’t need any physical vaults to keep your money. Because today the money is not more than the data stored in a cloud network, making it safer than ever.

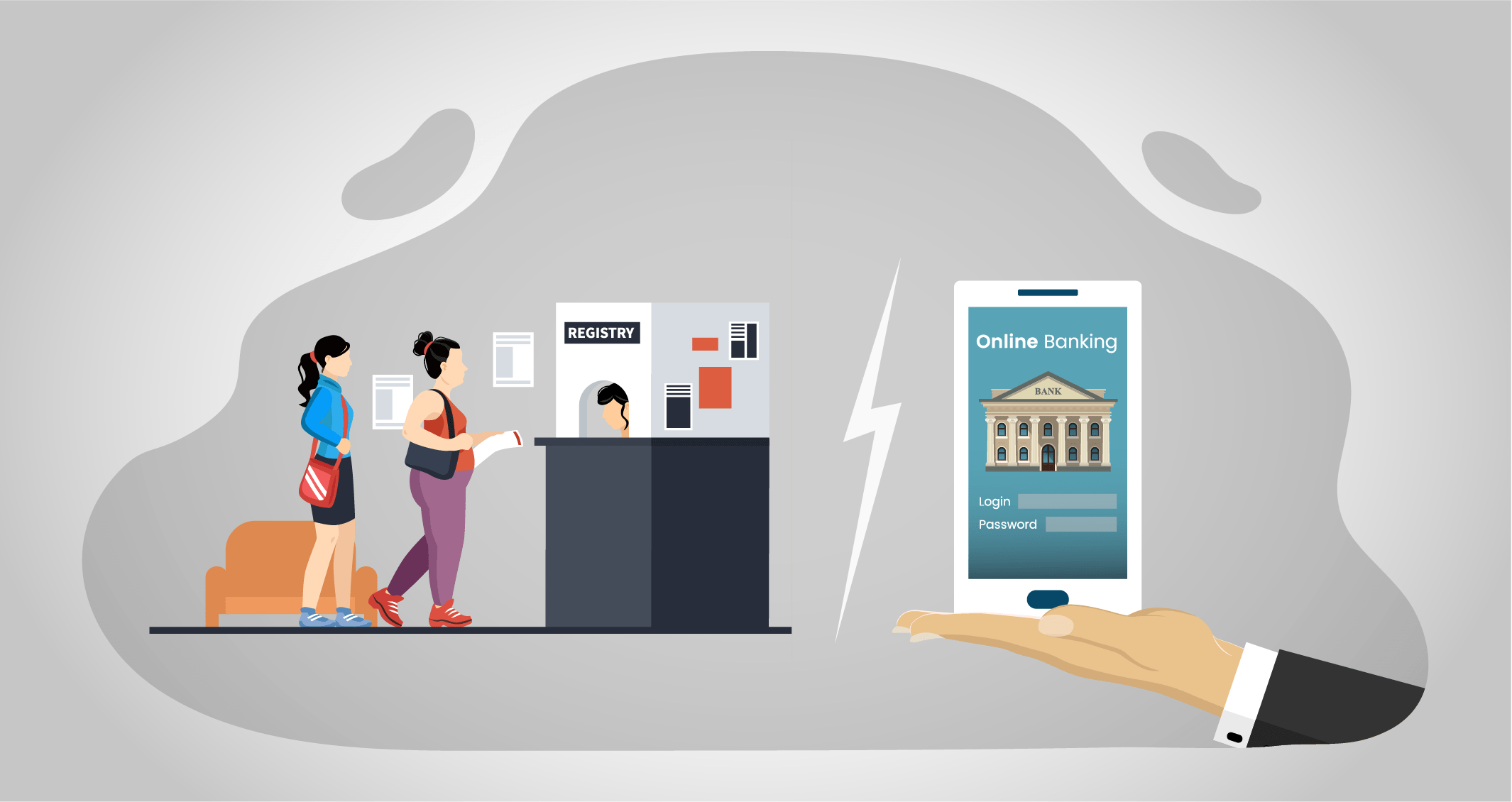

Transfer of Money or Payments

The other important feature of banks is the transfer of money or bill payments. Earlier, people used to go to the bank, stand in long queues completing the formalities, and then transfers were complete. However, with the rise of technology, you can now transfer money and make payments in just a few seconds with the help of all sorts of wallets and banks’ applications. The queues no longer exist in banks. Also, today banks are coming straight to your homes to deliver the comfort of banking from your home.

Availability of Loans

Another crucial feature of banks is to lend loans. Back in the day, banks provided loans only by keeping some valuables as collateral or guarantee. If the borrower did not repay the loan, then the valuables were diluted to compensate for the loans. Today, banks operate on the same principle. However, now there are so many loans and schemes that differentiate the two eras. Today you have loans for each of your requirements, like an auto loan, personal loan, loan against your property, home loan, consolidation loan and many more. Today your loans get disbursed in less time irrespective of all the formalities. However, before this shift happened, the loan disbursal process forced you to visit the banks 5 to 6 times.

Investment Options

Banks are one of the best options of investments and less risky as compared to the other options in the market. Nonetheless, the investments options and its mode have changed drastically. As I write now, it is going more towards automated investment, “a concept that is about to kill a lot of a middleman’s job”. Today you have the entire investment market on your mobile device, and you can invest with just by few clicks.

Banking has evolved with the evolution of humans, and it will continue to do so. It has always been a consumer-driven service & therefore, with the changing needs of customers, banking is also changing.