Pyramid Schemes: What They Are and Why You Need to Run in The Opposite Direction

The path to becoming a crorepati is one full of toils and trials. It’s no surprise that people are always on the lookout for easy ways to earn an additional income. The best way to do this would be by starting a side hustle as a freelancer or begin cleverly budgeting and investing your money. Though, some people opt to sign up for certain programs that promise to make them rich quickly.

These organisations offer gullible and desperate individuals Pyramid Schemes or “get-rich” schemes. They attract potential victims by offering the opportunity to make lakhs of rupees by simply selling products or signing up more people. The latter being the most common.

But, what’s a Pyramid Scheme?

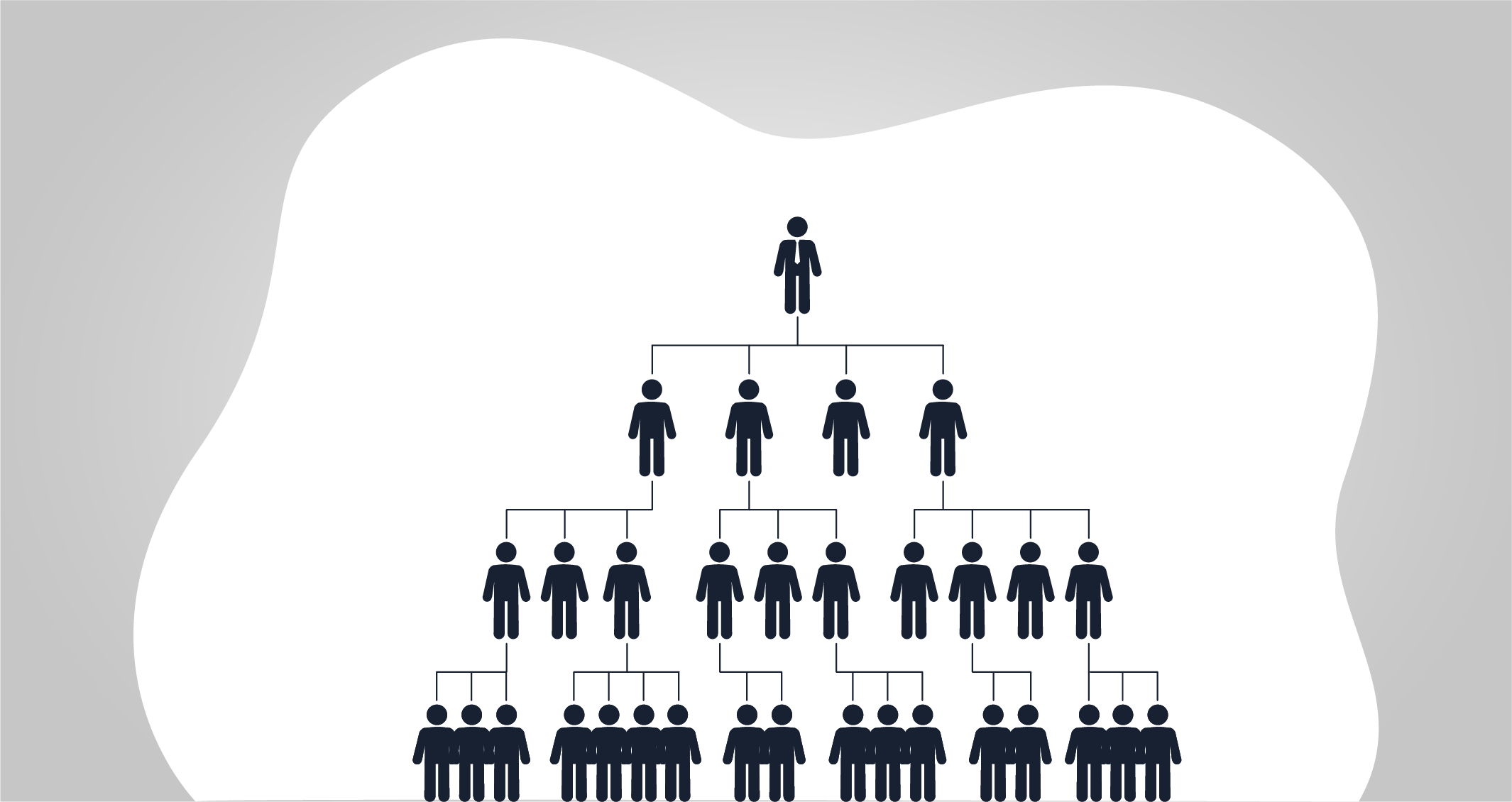

Pyramid Schemes are shady programs that are built on unsustainable business models. To stay afloat, these schemes heavily rely on recruits who pay a joining fee. This payment is then distributed to old recruits, who are at the top of the pyramid.

This may seem like a great way to earn extra income, but it has a glaring weakness. If the flow of new recruits dries up, the organisation will go under and the bottom of the pyramid (new recruits) will suffer massive losses. Though, those at the top will already have made their profits.

Types of Pyramid Schemes

Pyramid Schemes come in various forms, and while some are legitimate businesses, here are a few types you need to be wary of. Bus

1. Multi-Level Marketing (MLM) Schemes

This is a legitimate business model, which requires individuals to purchase products from the organisation and sell them to potential new recruits. The catch? These organisations make their profits by selling products with no retail value at a high cost to new recruits.

2. Chain Mails

The victim may receive an email or letter that contains instructions to donate money to all the people listed within the mail. After the donation, you can replace the first name in the list with yours and send it forward to friends and family.

3. Gift Promotions

Some Pyramid Schemes are hidden under the shroud of gift promotions, often circulated through investment clubs. This starts with a recruiter receiving a gift, followed by them signing up more people. Both the new and old recruit will receive gifts, and the cycle goes on.

Identifiable Features of Pyramid Schemes

With so many different types of Pyramid Schemes running rampant online and offline, one needs to be careful when approached by suspicious agents or notifications.

- Sale of products or services with zero retail value, unlike legitimate products that already have a consumer base

- They explicitly make recruiting your primary target, not the sale of goods or services

- Unrealistic guarantees to become rich overnight, or make massive gains in a short amount of time

- The compensation process is unnecessarily complicated, with continuous payment hold-ups for indefinite periods

- There is no proof of how the organisation earns its revenue, or these queries are sidelined and ignored by agents

Despite Pyramid Schemes having so many tell-tale signs, people regularly get lured into them. After all, who doesn’t want to become wealthy? These schemes are constantly evolving, finding new avenues that seem legitimate to fool unsuspecting people. This has forced the government of India to step in.

The RBI on Pyramid Schemes

The Reserve Bank of India (RBI) has cautioned citizens on the negative repercussions of engaging with Pyramid Schemes. To monitor suspicious activities like Pyramid Schemes, the RBI has put out the Prize Chit and Money Circulation (Banning) Act, 1978. This recognises involvement with or acceptance of money through Pyramid Schemes/Illegal MLMs as a legal offence.

Also Read: Financial Planning Mistakes You’re Making

Fallen for a Pyramid Scheme? Do the following!

If you have become a victim of Pyramid schemes, immediately report the incident to the local police department. In case this occurred online, approach your nearest cybercrime branch.

Always exercise caution when dealing with such schemes. Remember, prevention is better than cure!