Taking Control of Your Finances Leads to True Freedom

Different people define ‘financial freedom’ in different ways. While some interpret it as the freedom to buy or spend whenever they want, it means becoming debt-free or having enough savings for others. While all these interpretations hold true, they present only half the picture. In reality, financial freedom means having enough investments, savings, and in-hand cash to afford a healthy lifestyle for yourself and your family.

In other words, how to have enough income remaining after all your expenses to cope with debt, emergencies, etc. It is not just about being rich but also about how you can spend your time doing something you like rather than only earning money. You can achieve this only if you are ready for it, which takes a little financial planning. Moreover, it means creating a stockpile that will look after your post-retirement days or allow you to take up any career you want.

Freedom through Control

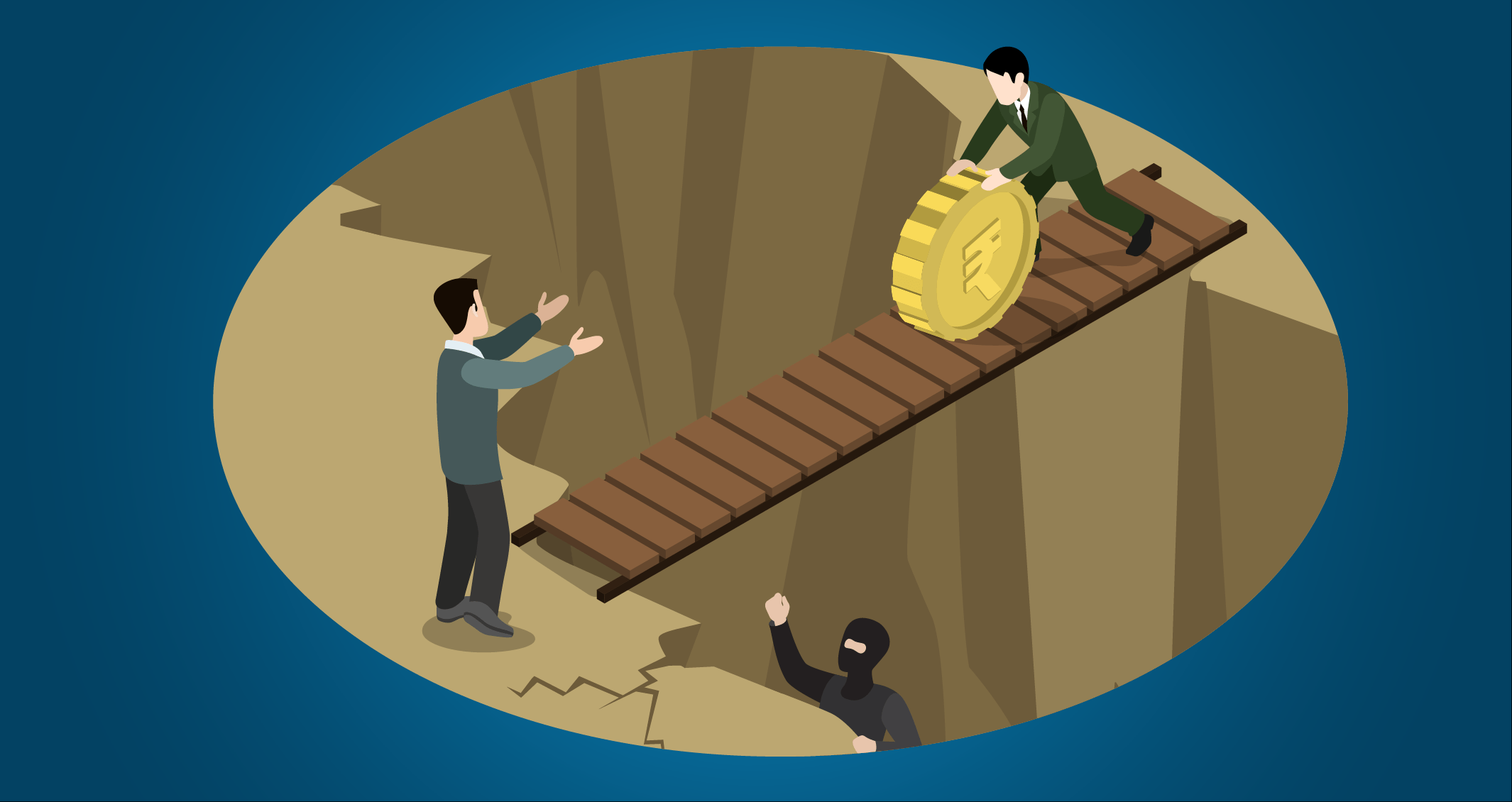

To truly be free, you need to first understand the importance of being in control of your finances and act accordingly to gain that dominance. Not taking control of your finances can lead to you falling prey to someone else’s control. The signs of financial restraints can be overt or subtle; but they become more prominent with time. Negative practices can lead to hiding information, losing one’s access to their assets, and reduced accessibility to financial channels.

In a number of cases, you can also lose your financial freedom in a relationship. Several examples show that a partner may start to show these trends and try to control their better half’s financial activities when they are trying to leave the relationship behind. We tend to miss the red flags of financial abuse because the abuser often acts from behind the smokescreen of love.

Caught in the Debt Net

Often you might be facing a situation where you are forced to take on excess loans for repaying your existing debts and liabilities. This scenario is known as a debt trap. Over time, you tend to get further stuck as the debt gradually spirals out of your control. It exceeds your repayment capacity, leaving you completely stuck in the debt net and your finances at someone else’s mercy. Debt trap can take on many forms. You can prevent it by knowing how it might take place –

- You have too many loans or have the habit of taking a loan easily

- Your loans or EMIs amount to over half your income

- 70% of your income goes to funding your fixed expenses

- You have overspent your credit card limit

- You cannot manage to save money for your future

A Coping Mechanism

Often, it might be that we have gotten out of a vicious cycle of financial troubles, but from the ashes of that trauma, we fall into another loop. Have you ever seen that shopping for new clothes, accessories, gadgets, or spending on art supplies, home decor, and other lavish services makes you feel good? Well, you’re not wrong. Our subconscious reads this as a form of reward, releasing a hormone called dopamine. This triggers a rush in our minds and immediately lifts our mood. This is why excessive spending and shopping is called ‘retail therapy’.

However, this respite from the dull and lull of daily life is nothing but an escape that can soon develop into a compulsive behaviour, often costing more than they set out to spend. In today digital age of round-the-clock online shopping, it is more difficult to resist such impulses. Compulsive shopping is an often-ignored condition that can bankrupt your finances. Today’s consumerist culture considers retail therapy a commonplace and glamorous addiction, discouraging one from seeking help. Instead, it is a toxic coping mechanism that can cripple your financial freedom and must be chucked without delay.

From a Penny to a Pound

Living on your paycheck from day to day, making lavish expenses and being irresponsible regarding your finances can land you in a soup. It is essential to recognise behaviours and patterns you may have adopted and can’t get rid of. Avoiding such mechanisms and paving the way for a healthy monetary routine of planning, budgeting, and limited spending can ensure that you make the most of your income!

- If you have an emergency corpus saved, you will not have to put off your monthly expenses or take on debt.

- If your savings can afford it, you can take a much-needed break from your job without worrying about the costs.

- If you are earning enough, investing wisely and saving up, you will find that elusive financial happiness, enjoy the small things, and continue the cycle.

- If you are sure of your financial standing, you can afford to leave the daily hustle behind and follow your interests without going broke.

- If you adjust your expenses or downsize certain lavish habits, you will manage to save up for an early yet comfortable retirement.

The Path to Recovery

For victims of financial difficulties, this road is tough and expensive. Even if you break off from your financial chains, you might be neck deep in debt with a hole in your pocket and an uncertain future. There are still some ways to mitigate the damage by taking these actions –

Contact financial institutions: Work with them to update your identity details, personal information, and passwords to secure your account and make your private information confidential again. If possible, open new accounts wherever possible

Report unauthorized credit usage: Go over your free credit with a fine-tooth comb. The minute you spot some irregularity, or some expense you can’t recall, report it immediately to your credit provider and take steps to block your credit access

Work with the law: Get it touch with your local police officials and known attorneys and seek to file criminal charges if anyone has tampered with your finances and sue them for the financial loss and harm that they caused you.

Save all copies: While it is more of a pre-emptive measure, hence likely to be missed, try to keep on-paper proof of your partner’s income and employment details. Correspondingly save all forms of communications including texts and mails to and from the abuser.

Take a fresh financial approach: Start small but start saving and invest that money to regrow your financial base as early as possible. Having a goal-based approach to this can help you determine how much to contribute to each investment alongside your monthly expenses.

Starting Afresh

Save as much as you can since the future is nothing but uncertain. No matter how well off you are or how much you have stored up for a rainy day, your finances can always go downhill.

Setting aside a few bucks every day, whether it be in your personal stash, in your private savings account, or in the form of some investments, this money will help you start a new financial journey. Moreover, saving wisely, such as in Fixed Deposits or, investing the money in schemes like Mutual Funds will make sure that you do not take to the road empty handed.