How is Bajaj Markets UPI Best for You?

As per published RBI reports, the value of bank notes in circulation, 2018- 2019, is Rs 21,109 Bn & 108,759 Mn pieces. The above does not include the coins in circulation for the same period which is Rs. 258 Bn & Rs. 120,324 Mn pieces. Now try and imagine the costs associated with such huge amounts of cash in circulation.

Let us try to imagine some of the costs involved:

- Money movement costs – Manpower, insurance, Fuel

- Opportunity costs on money lying idle (ATMs, shops, etc)

- Threats such as fake currency, black money, tax evasion, pilferage

While all the above give us good reason what has been some of the major roadblocks in digitization of payments?

- Costs of accepting non-cash payments (high MDR)

- Connectivity issues for mobile payments and lack of ubiquity

- Process & privacy issues (multiple steps for IMPS/NEFT payments, exposing account information to strangers)

Let us try to understand how UPI has changed the paradigm of payments in this fast-evolving payment space.

UPI stands for Unified Payments Interface and it is an instant real-time payment system developed by NPCI (National Payments Corporation of India) to facilitate interbank transfers on real time basis for the users. UPI has grown at a rapid pace and is well on the way to touch 1 billion transactions in a month as per the current trajectory.

What makes UPI so successful?

To quote Leonardo da Vinci “Simplicity is the ultimate sophistication”. And that is exactly what I feel NPCI has achieved through UPI. A solution which is simple enough to solve complex problems such as costing, privacy, process and ubiquity. The rapid growth of availability of low cost data with technological advances and the intent of some large players to create inroads into India’s payment space powered by cashbacks has added fuel to this growth story.

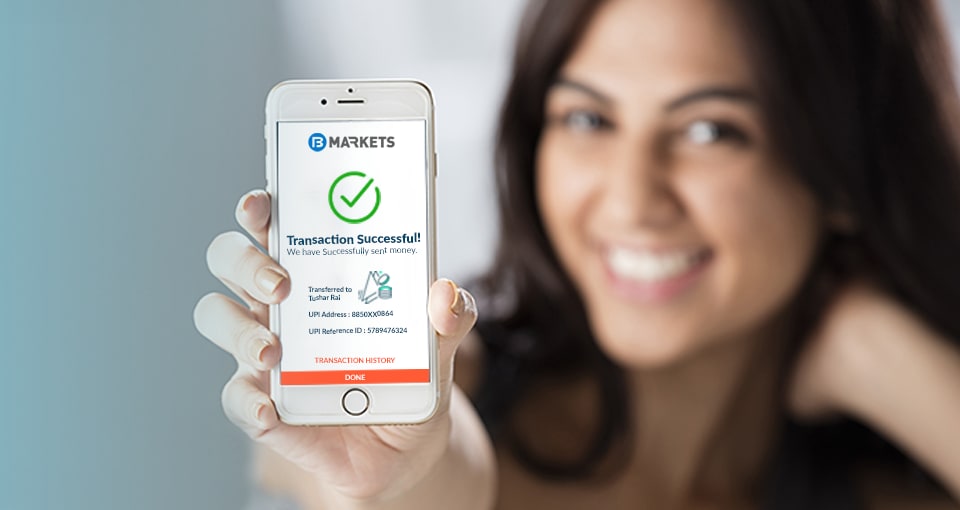

Why UPI on the Bajaj Markets App?

UPI offers simplicity and ease of transactions. There are multiple options today available to the consumer to create and link UPI handles. It is important as a consumer to choose the right Apps to use UPI. Some of the important factors that I feel one might want to consider while choosing would be

- Reputation of the App provider

- What does the App provide in addition to UPI services?

- The ability to provide in house financial services

- Range of services such as no cost emi, mutual funds, digital gold, loans, deposits, insurance and more

Bajaj Finserv Direct Ltd is a wholly owned subsidiary of Bajaj Finserv which is the financial services company of the Bajaj Group and its current business lines include Lending and Wealth Advisory services through Bajaj Finance Limited and Protection through Bajaj Allianz Life Insurance and Bajaj Allianz General Insurance.

Bajaj Markets App provides a range of services in addition to UPI. These services include loans (personal loans, home loans to name a few), investments (fixed deposits, mutual funds, ULIPs to name a few), credit cards, protection (general and life insurance), financial fitness reports, No Cost EMI options and EMI card. Bajaj Markets App acts as a one stop shop to cater to your financial needs with the introduction of its financial services super App.

It also provides a unique advantage of providing many services from within the Bajaj Group. This in turn creates a handholding and joint ownership within the group and helps in a better consumer experience. Also, being part of the Bajaj Finserv family, Bajaj Finserv Direct Ltd. will be able to understand its customer requirements proactively and work with the group companies to proactively create solutions for its customers in a timely and fast manner.

Bajaj Markets App provides more than 20 different products within the App. By a tie-up with external partners for products which are not currently offered by companies within the Bajaj Finserv umbrella which exhibits the seriousness and commitment of Bajaj Finserv Direct Ltd. towards its users and consumers. It also provides the facility of linking the availed services within the Bajaj Markets App making it easy to keep track, view and monitor from a consumer perspective.

Bajaj Markets, a subsidiary of Bajaj Finserv, is a one-stop digital marketplace that has been created for consumers on the go. It offers 500+ financial and lifestyle products, all at one place. At Bajaj Markets, we understand that every individual is different. And that’s why we have invested in creating a proposition – Offers You Value. A value proposition that ensures you get offers which are tailor made for you. We also offer an amazing product range and unique set of online offers across Loans, Insurance, Investment, Payments and an exclusive EMI store. Be it in helping you achieve your financial life goals or offering you the latest gadgets, we strive to offer what you are looking for. From simple and fast loan application processes to seamless and hassle-free claim-settlements, from no cost EMIs to 4 hours product delivery, we work towards fulfilling all your personal and financial needs. What’s more! Now enjoy the same benefits in just one click with our Bajaj Markets App.