India is Embracing New Payment Methods. Are You?

The exponential growth of the digital payment sector is driven by multiple factors including convenience to pay along with the ever-growing smartphone penetration. This has contributed significantly to the rise of non-banking payment institutions such as payments bank and digital wallets. Progressive regulatory policies along with increasing consumer readiness have triggered a digital payment revolution.

The convenience to pay along with the availability of lucrative offers are two key factors that have been driving the growth of digital payments in India. The introduction of innovative payment solutions like Bajaj Finserv EMI Card too has contributed to the growth of digital payments. With the Bajaj Finserv EMI Card, people can enjoy the benefits of EMI without a credit card and use it to buy the latest product offerings from a host of leading brands like Apple, Sony, Panasonic, Dell, Saregama, Vivo and Oppo, among others, on the Bajaj Finserv EMI Store. Coupled with increasing smartphone penetration the availability of various e-commerce platforms has proved to be a boon for the digital payments sector. Facts suggest that India has the third-largest internet user base in the world with 300 million users. Over 50% of these users are connected to the internet through mobile. ‘Mobile only’ users, i.e. around 150 million mobile-only internet users’ are playing a key role in the growth story of digital payments.

At the same time, it is important to note that the advent of next-generation payment systems like payment banks, digital wallets and BharatQR, is fueling digital payments furthermore.

Projections are that digital payments in India will supersede cash by 2022, according to the IDC Financial Insights report titled ‘The Future of Payments in India: More Spectacular Growth Ahead’.

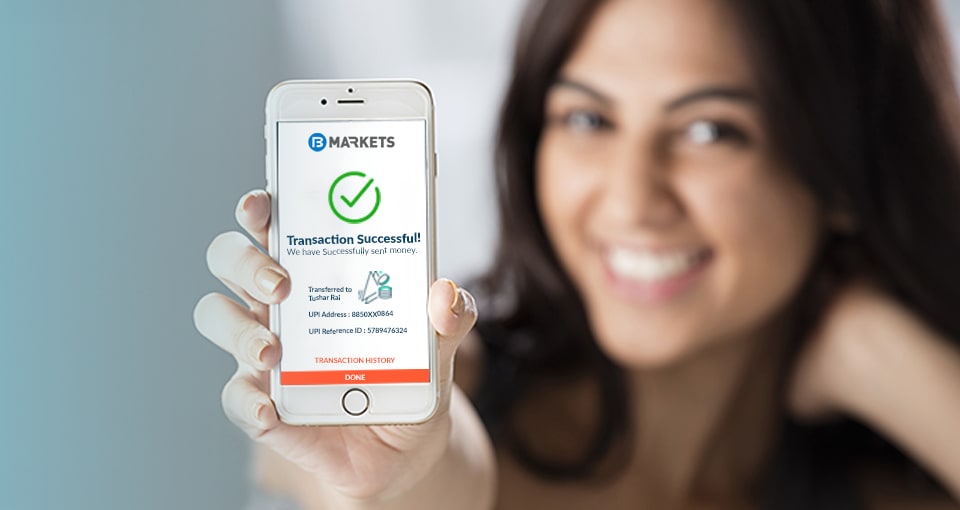

Positive policy framework changes and government initiatives like the launch of new payments systems like UPI, Aadhar linked electronic payments and the improvement of the digital infrastructure are important drivers for digital payments in India. Bajaj Markets now offers the UPI facility which makes digital transactions all the more safe, secure and speedy. You can revel in the ease of going cashless with this facility!

Comparison with global market

Compared to 25 countries surveyed by FIS, a US-based banking technology company, India has the most evolved digital payments ecosystem. The surveyed countries included the UK, China and Japan. The parameters that FIS used to measure the digital payments in these 25 countries include round-the-clock availability of the services, adoption, and immediacy of payments.

FIS’ Flavors of Fast used the Faster Payments Innovation Index (FPII) rates different payment system across these 25 countries on a scale of 1-5, with 5 being the highest rating. If we compare the digital ecosystem, India’s IMPS service was the only system to get a level 5 rating, leaving behind countries like the UK, Singapore, Denmark, Switzerland, China, Japan, and others

The Road Ahead

With such tremendous growth in the past, it can be safely said that the sector will witness tremendous growth, innovation and will receive regulatory support. Such has been the transformation that India has become the most evolved country in the digital payment ecosystem. The focus should be to keep the momentum going with more support from the government and innovations from the private sector. That is why we need innovative digital platforms like the Bajaj Markets, an integrated portal selling products ranging from insurance to the best Samsung phones, the latest iPhone models and the newest LG TV sets. A helping hand from large private players coupled with conducive government policies can do wonders for the digital payments sector.

Bajaj Markets, a subsidiary of Bajaj Finserv, is a one-stop digital marketplace that has been created for consumers on the go. It offers 500+ financial and lifestyle products, all at one place. At Bajaj Markets, we understand that every individual is different. And that’s why we have invested in creating a proposition – Offers You Value. A value proposition that ensures you get offers which are tailor made for you. We also offer an amazing product range and unique set of online offers across Loans, Insurance, Investment, Payments and an exclusive EMI store. Be it in helping you achieve your financial life goals or offering you the latest gadgets, we strive to offer what you are looking for. From simple and fast loan application processes to seamless and hassle-free claim-settlements, from no cost EMIs to 4 hours product delivery, we work towards fulfilling all your personal and financial needs. What’s more! Now enjoy the same benefits in just one click with our Bajaj Markets App.