What is UPI After All?

United Payments Interface (UPI) is an instant payment system which allows immediate transfer of funds from one bank account to another through a mobile phone platform. It is a single mobile application which can be used for accessing various bank accounts. Developed by the National Payments Corporation of India (NPCI), a body regulated by the Reserve Bank of India (RBI), UPI is built over the Immediate Payment Service (IMPS) infrastructure for instant transfer of funds. It is faster than National Electronic Funds Transfer (NEFT) and uses the Virtual Payment Address—a unique id provided by banks. UPI is controlled both by the RBI and Indian Bank Association (IBA).

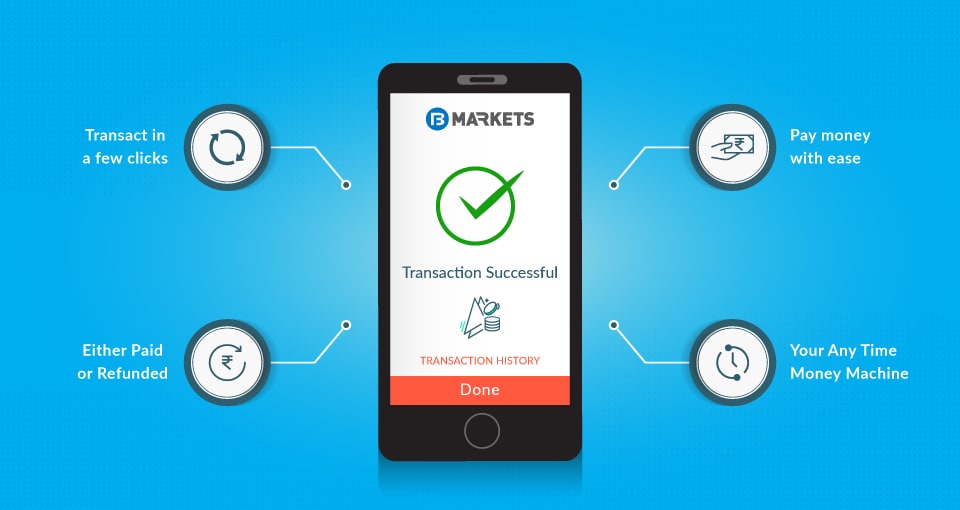

How does the UPI payment system work: First, you are required to set up an account for each bank account you want to use. You will then be able to create a unique ID for each bank account. Now you can use this unique ID to receive payments, pay for different products and services, or make transfers directly through your account. You can use the UPI payment system in the following five steps:

- Step1: Download the Bajaj Markets UPI-enabled App from Playstore (for Android phone users), or from the bank’s website.

- Step 2: Enter details, including name and age to create a unique ID. The ID could be your name, phone number of Aadhaar number. This unique UPI ID is also known as Virtual Payment Address (VPA).

- Step 3: Link the bank’s name, account number and IFSC code with your virtual ID.

- Step 4: For carrying out a transaction, select the bank account and generate Mobile Pin (M-PIN). Now enter the last six digits of your debit card along with the expiry date. Enter OTP received on your phone along with the secret M-PIN. Now press submit to complete the transaction.

- Step 5: You can now use the Bajaj Markets UPI app for instant transfer, besides requesting for fund transfers by sharing your UPI ID. Unlike NEFT or RTGS transfers, the UPI payment system can be used round-the-clock.

What is BHIM?

Bharat Interface for Money (BHIM) is a smartphone based app which uses UPI technology to provide instant money transfer. Mobile payments app like Google Pay along with Bajaj Markets App and digital wallets like Paytm, MobiKwik and PhonePe have BHIM UPI in their interface.

Advantages of UPI: The foremost benefit of UPI is the ease of carrying out a completely secure transaction. Other benefits are as follows:

- Though there are transaction limits on different apps, UPI transactions are completely free from any charges, unlike NEFT or RTGS.

- You don’t need to provide details like account number while carrying out UPI transactions. You just need to provide the VPA or the unique UPI ID. You can just say goodbye to the tedious process of adding a new payee, and then waiting for bank’s approval to make money transfers.

- Unlike NEFT or RTGS transfer, you can carry out UPI transactions round-the-clock. Using UPI, you can instantly transfer money, 24×7.

- You just need your smartphone to carry out UPI transactions, including approving payments and initiating money transfer. A single app can be used to handle different bank accounts.

Which banks support UPI payments?

According to NPCI’s data, there are a total of 141 banks supporting UPI payments in India. Of these, 48 use their own apps, while the rest rely upon third-party apps for carrying out UPI transactions.

UPI transactions in India: UPI has emerged as the major mobile-only digital payment platform in the country. The total number of UPI transactions stood at 82.22 crore in July 2019 as compared to 23.56 crore transactions in July 2018. The daily average transactions stood at 2.65 crore in July 2019, an increase of 248.68% from the figures of 76.01 lakh in July 2018. The total amount transacted on the UPI platform stood at a staggering Rs 1.46 lakh crore in July 2019. This amount reached an all-time high of Rs 1.52 lakh crore in May 2019.

Conclusion

Thus, United Payment Interface is a system which not only allows users to transfer money between various bank accounts but also acts as a single-window mobile payment system for a slew of payments like OTC payments, in-app payments, merchant payments and utility bill payments. The key highlight of United Payment Interface is the VPA, or the unique virtual ID, which absolves the user from the necessity of remembering multiple details like bank account number, IFSC code, net banking user id and password, etc. The VPA becomes the sole financial address of the user, thus allowing for fast, secure and convenient transactions.

Bajaj Markets, a subsidiary of Bajaj Finserv, is a one-stop digital marketplace that has been created for consumers on the go. It offers 500+ financial and lifestyle products, all at one place. At Bajaj Markets, we understand that every individual is different. And that’s why we have invested in creating a proposition – Offers You Value. A value proposition that ensures you get offers which are tailor made for you. We also offer an amazing product range and unique set of online offers across Loans, Insurance, Investment, Payments and an exclusive EMI store. Be it in helping you achieve your financial life goals or offering you the latest gadgets, we strive to offer what you are looking for. From simple and fast loan application processes to seamless and hassle-free claim-settlements, from no cost EMIs to 4 hours product delivery, we work towards fulfilling all your personal and financial needs. What’s more! Now enjoy the same benefits in just one click with our Bajaj Markets App.